Securing a vehicle finance loan as a self-employed Australian can be challenging. Proper preparation and understanding of lender requirements make the process easier. The right vehicle finance helps you grow your business, manage cash flow, and acquire essential vehicles. Knowing how to qualify, compare options, and avoid common mistakes is key. This guide provides practical tips, real-life examples, and strategies to secure the best financing for your business efficiently.

Understanding Vehicle Finance for Self-Employed Australians

Vehicle finance allows you to purchase a vehicle while spreading repayments over time. You can choose personal or business vehicle finance depending on your needs. Lenders consider income consistency, credit history, and business stability when approving loans.

Self-employed individuals must provide detailed financial records, including tax returns and business statements. Using a vehicle finance business option allows you to acquire work vehicles without straining cash flow. FGS Finance helps you organise documentation, choose suitable loan options, and secure terms that match your business requirements.

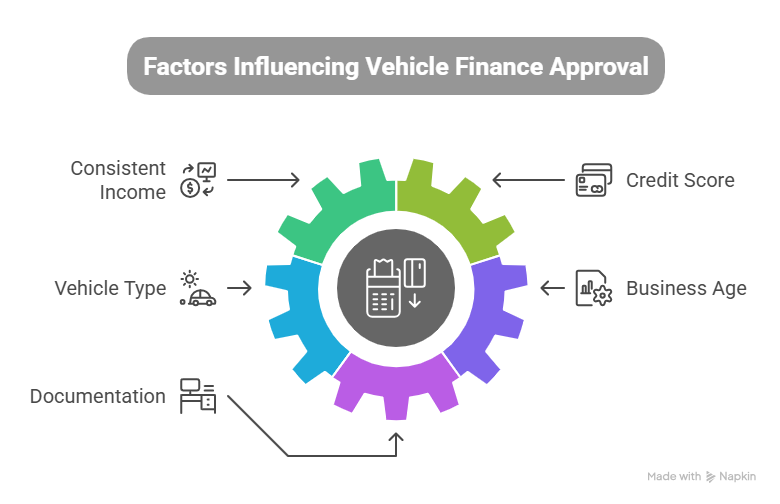

Key Factors Lenders Consider for Vehicle Finance Approval

Lenders evaluate specific aspects before approving how to get vehicle finance for self-employed Australians. Preparing these factors correctly improves your chances and helps secure better interest rates.

- Consistent income and financial statements

- Credit score and repayment history

- Vehicle type and intended business use

- Business age and operational stability

- Complete and transparent documentation

Proper preparation demonstrates reliability to lenders. FGS Finance helps you showcase your strengths and present a compelling case for fast approval of vehicle finance.

Real-Life Success Stories of Self-Employed Vehicle Finance

A tradesperson secured vehicle finance to purchase a work van. With a reliable vehicle, job efficiency improved, and revenue increased. FGS Finance helped prepare financial records and select the right loan option.

A small business owner expanded their fleet using business vehicle finance. This allowed faster delivery services and more client coverage. Comparing lenders and choosing competitive rates ensured affordability and long-term success.

These examples show that planning, accurate documentation, and professional guidance make vehicle finance a powerful tool for business growth.

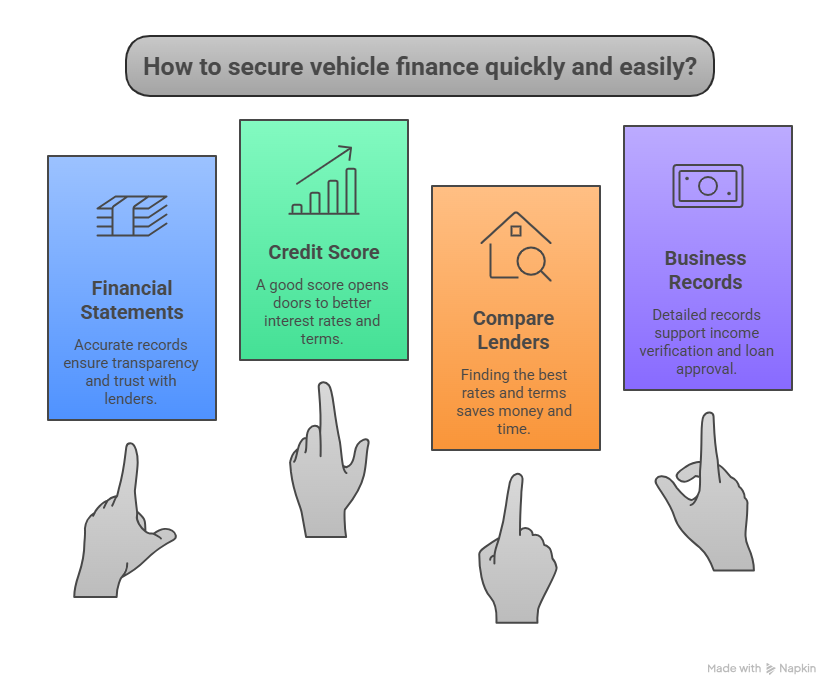

Tips for Securing Vehicle Finance Quickly and Easily

Obtaining vehicle finance can be fast with the right approach. Follow these strategies:

- Keep accurate financial statements and tax records

- Monitor and improve your credit score.

- Compare lenders to find the best interest rates and terms.

- Maintain detailed records of business operations and income.

Following these steps reduces delays, boosts lender confidence, and ensures smooth processing. FGS Finance assists self-employed Australians in preparing documents and securing loans efficiently.

Common Mistakes to Avoid

Many self-employed borrowers face delays due to incomplete documentation, ignoring credit scores, or underestimating repayment capacity.

FGS Finance helps you avoid these pitfalls by preparing precise financial records, selecting the best vehicle finance options, and creating a manageable repayment plan. Working with experts ensures faster approval and long-term business stability.

Top 5 FAQs About Vehicle Finance for Self-Employed Australians

- What is vehicle finance?

A loan or lease that lets you purchase a vehicle while spreading repayments over time.

- Can self-employed people get vehicle finance?

Yes, with proper income verification and business documentation.

- How do lenders assess applications?

Lenders review income consistency, credit history, and business stability.

- Can I use the vehicle for both personal and business purposes?

Some lenders allow mixed-use, but terms may vary.

- How quickly can I get approved?

Approval depends on documentation and lender processes, typically taking a few days to weeks.

Conclusion

Securing vehicle finance as a self-employed Australian requires preparation, accurate financial records, and understanding lender requirements. Proper planning helps you acquire vehicles that improve operations, efficiency, and business growth.

FGS Finance guides self-employed Australians in selecting the right loan, preparing documentation, and securing fast approval. Call 0431 170 021 or email info@fgsfinance.com.au today for expert advice and support to get your vehicle finance quickly.