Understanding the Costs and Fees of a Property Development Loan Australia

A property development loan Australia helps fund construction or investment projects. Understanding costs keeps your project profitable. Fees differ between residential and commercial developments. Proper planning reduces hidden charges and surprises. FGS Finance guides you to choose the right loan for your project.

What is a Property Development Loan in Australia?

A development loan Australia provides funds for property construction or investment. It covers land purchase, building costs, and other expenses. Residential and commercial projects need different loan types. Lenders review your project plan and financial history before approval.

Most development loans are short-term and higher risk than standard home loans. They often release funds in stages, depending on project progress. Comparing lenders helps find the best interest rates and lower fees. Understanding loan structures ensures no unexpected costs appear.

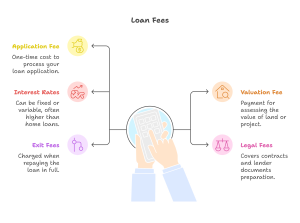

Key Costs and Fees Associated with Development Loans

Applying for a development loan in Australia involves various fees. Knowing these costs helps plan your budget effectively.

- Application Fee: One-time cost to process your loan.

- Valuation Fee: Paid to assess land or project value.

- Interest Rates: Can be fixed or variable, often higher than home loans.

- Legal Fees: Covers contracts and lender documents.

- Exit or Settlement Fees: Charged when repaying the loan.

Understanding these fees keeps your project profitable. FGS Finance helps you

identify costs before signing any agreement.

Factors Affecting Development Loan Costs

Loan costs depend on project type and size. Residential developments usually cost less than commercial ones. Larger projects often attract higher fees.

Your experience and financial record influence lender decisions. First-time developers may pay more fees or interest.

Loan structure matters. Staged disbursements, loan term, and project risk affect total costs. Choosing FGS Finance ensures flexible solutions with transparent charges.

Tips to Minimize Costs and Fees for Development Loans

Reducing fees starts with planning. Smart strategies save money and improve project returns.

- Compare multiple lenders and their fees.

- Negotiate interest rates and charges.

- Work with a broker experienced in development loans.

- Keep strong financial and project documentation ready.

Using these tips keeps your development on budget. FGS Finance guides you through every step. Whether it’s a residential development loan Australia or commercial, planning wisely reduces costs.

Residential vs Commercial Development Loans

Residential development loans Australia are for houses or apartment projects. Interest rates and fees are usually lower than commercial loans.

Commercial construction development loan Australia supports offices, retail centers, or larger projects. Lenders require detailed plans and assessments. Fees and interest rates are higher due to increased risk.

FGS Finance helps you choose between residential or commercial loans. Developers get the best financing options without extra costs.

Top 5 FAQs About Property Development Loans in Australia

- What is the difference between residential and commercial development loans?

Residential development loans fund housing projects like single homes or apartment complexes. Commercial loans support larger business or investment developments, such as offices or retail spaces. - How much deposit is needed for a development loan?

Deposits are usually 20–30% of the total project cost. The exact amount depends on the lender and the type of project. - Can I refinance a development loan?

Yes, refinancing is possible during or after the project. Fees and eligibility depend on your lender and how the project is progressing. - Are interest-only loans available?

Yes, many development loans allow interest-only payments while construction is underway. This helps reduce early-stage cash flow pressure. - How do lenders calculate development loan fees?

Fees are based on loan size, project type, and your financial background. FGS Finance ensures all charges are transparent and easy to understand.

Understanding the costs of a property development loan Australia keeps your project on track. FGS Finance helps plan budgets, compare lenders, and minimize fees.

Contact FGS Finance today at 0431 170 021 or info@fgsfinance.com.au. Our team helps you secure the right residential or commercial development loan Australia. Trust FGS Finance to guide your project from start to finish.