Refinancing your home can save you money and improve financial flexibility. Many Australians struggle to choose between fixed and variable rates. This guide explains the differences and benefits of each option. Learn how to select the best home loan for refinancing in Australia. FGS Finance helps you make smart, informed decisions for your home loan refinance.

Understanding Refinancing in Australia

Refinancing in Australia allows you to replace your current home loan with a new one. This can reduce your interest rate, lower your monthly repayments, or improve your loan terms. Many homeowners choose home loan refinance to manage finances more effectively.

The Australian market offers many options for home loan refinance online. Comparing lenders, rates, and loan features helps you find the best solution. Understanding fixed and variable rates is key. FGS Finance guides clients to the right refinance option based on personal financial goals and property needs.

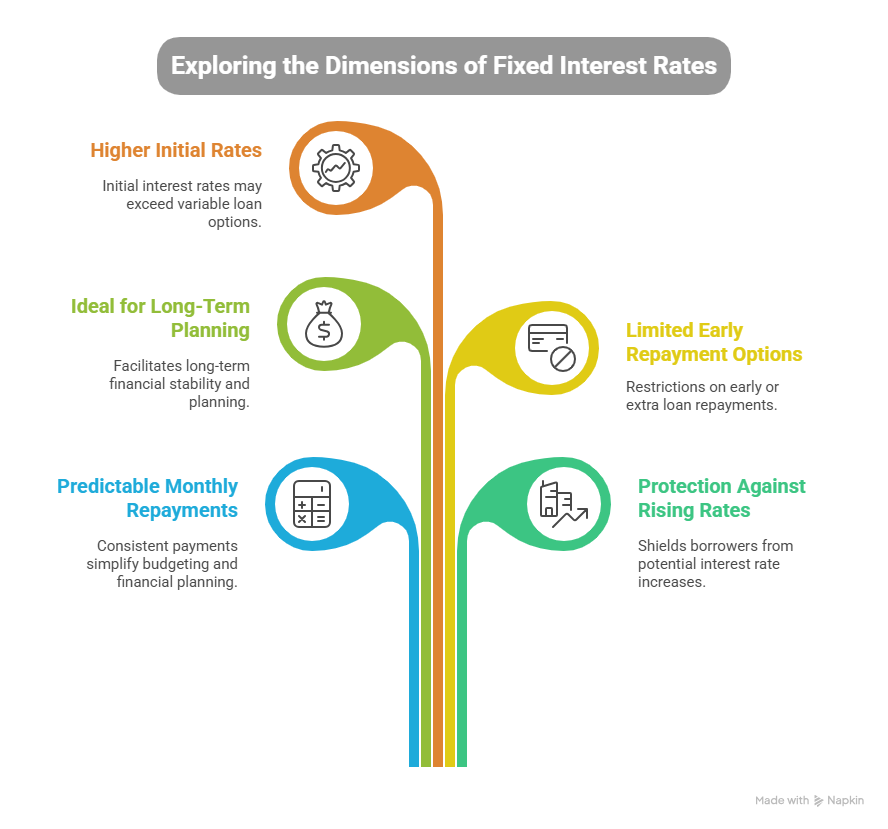

Fixed Interest Rates – Pros and Cons

Fixed Interest Rates-Your Anchor in Uncertain Times

- Predictable monthly repayments for easy financial management.

- Protection against rising interest rates.

- Ideal for long-term financial planning.

- Early repayment or extra payments may be limited.

- Initial rates may be higher than variable loans.

Fixed rates suit borrowers who value certainty. FGS Finance helps you assess if a fixed-rate refinance fits your budget and long-term plans.

Variable Interest Rates – Pros and Cons

Variable Interest Rates-Your Ticket to Financial Freedom

Advantages include lower initial rates, freedom to make extra repayments, and potential savings. Risks include increased repayments if rates rise. Monitoring the market is essential to avoid surprises.

Evaluating a variable loan requires understanding your financial situation and risk tolerance. FGS Finance assists with home loan refinancing online by comparing variable and fixed options to find the most suitable loan.

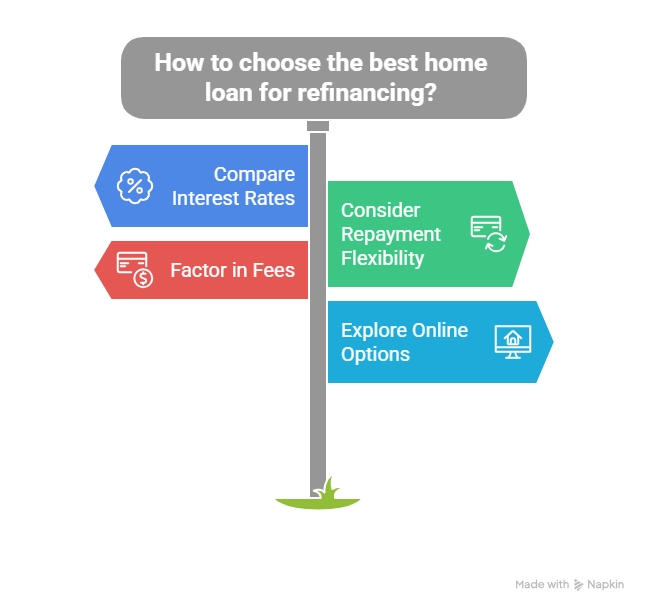

How to Choose the Best Home Loan for Refinancing in Australia

Choosing the right loan saves money and ensures financial stability. Your refinance should match your budget, lifestyle, and future goals.

- Compare interest rates and features from different lenders.

- Consider repayment flexibility to suit your financial needs.

- Factor in fees, charges, and exit penalties.

- Explore home loan refinance online options for convenience.

FGS Finance provides expert advice to find the best home loan for refinancing in Australia. Careful evaluation ensures lower repayments and better loan terms tailored to your situation.

Tips for a Successful Refinancing Process

Gather all necessary documents, such as income proof, expenses, and current loan statements. Clear records make approval faster and smoother.

Research lenders, compare rates, and calculate potential savings. FGS Finance assists in analysing options and guides you to the ideal solution. This ensures a hassle-free refinance with better terms and lower monthly payments.

Top 5 FAQs

What is refinancing in Australia?

Refinancing replaces your current home loan with a new one to get better rates or terms.

Should I choose a fixed or variable rate when refinancing?

Fixed rates offer stability. Variable rates provide flexibility and potential savings if interest drops.

Can I refinance online?

Yes, home loan refinance online is available and convenient for many borrowers.

Will refinancing affect my credit score?

A small temporary impact may occur, but savings and better loan terms outweigh it.

How do I find the best home loan for refinancing in Australia?

Compare rates, fees, and features. FGS Finance helps you identify the most suitable option.

Final Thoughts on Refinancing in Australia

Refinancing in Australia can improve financial flexibility and reduce repayments. Choosing between fixed and variable rates depends on your budget, risk tolerance, and goals.

FGS Finance guides homeowners through home loan refinance, comparing options and selecting the best deal. Start your refinancing journey with expert support. Contact FGS Finance at 0431 170 021 or email info@fgsfinance.com.au today.