Property investment in Australia is one of the most reliable ways to build wealth and secure your financial future. With the right plan, you can enjoy both steady rental income and long-term growth. Success in investment property depends on research, innovative strategies, and sound financial advice. Many investors look to experts for help in finding the best opportunities. This guide provides clear steps to help you make smarter choices in investment property in Australia.

Introduction to Property Investment in Australia

Suppose you are planning to start with property investment in Australia. In that case, you are taking a step that can bring both income and significant financial growth. An investment property allows you to build wealth by renting it out or by waiting for the value to rise over time.

Australians continue to see property as one of the most stable forms of investment. With the right approach, you can benefit from tax advantages, stable demand, and attractive investment opportunities in Australia. The key is to understand how the process works and to plan each step carefully.

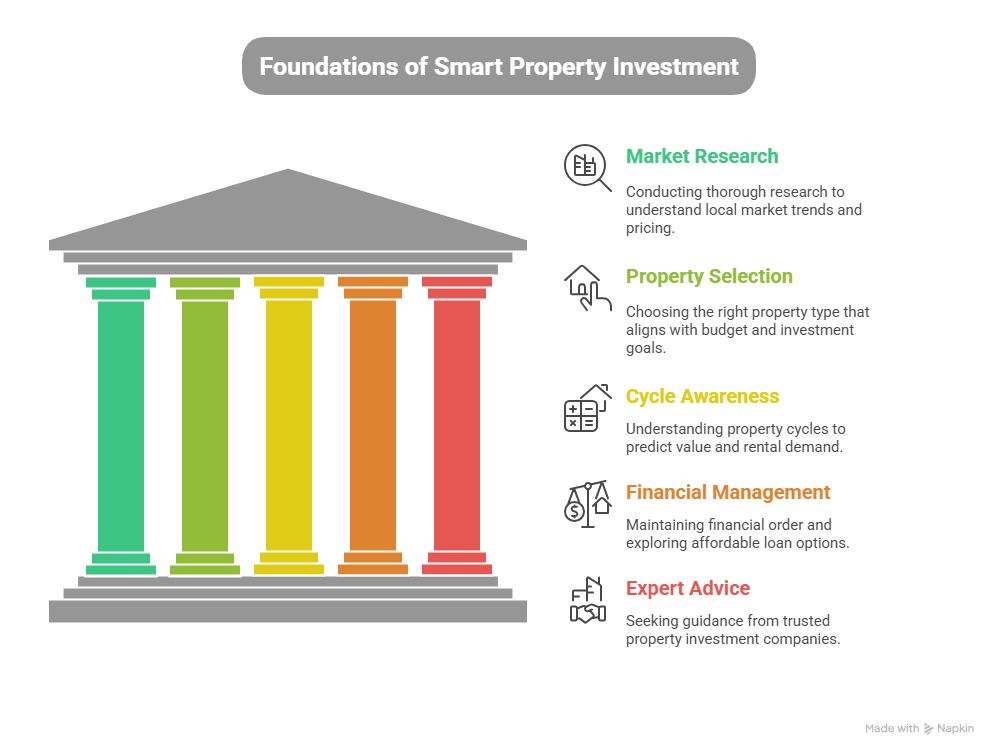

Key Tips for Smart Property Investment

Before you buy an investment property, it is important to prepare. Proper planning reduces risks and helps you reach your financial goals faster.

- Research the local market and compare prices.

- Choose the right property type that fits your budget and goals.

- Understand how property cycles impact value and rental demand.

- Keep your finances in order and explore affordable loan options.

- Work with a trusted property investment company for expert advice.

By following these steps, you lower the risks and increase the chances of success. Each decision you make, from location to finance, has a direct impact on the return you achieve from your property.

How Does Property Investment Work in Australia?

When you buy an investment property, your main goal is to create wealth. Some investors focus on rental income, while others rely on long-term growth. Many successful investors use both strategies to build a solid portfolio.

Property investment also comes with tax benefits. For example, you can claim expenses such as loan interest, maintenance, and property management. Many investors also use negative gearing, a strategy where the rental income is less than the expenses. Still, the tax benefits help balance the cost. This makes property an attractive option compared to other investments.

Like all investments, property comes with risks. Market changes, interest rate rises, or rental vacancies can affect your returns. That is why planning and professional support are important before you commit to a purchase.

Best Locations and Opportunities in Property Investment

Location is one of the most critical factors in property success. The right area gives you better rental demand and long-term growth.

- Investment property Queensland continues to attract investors due to population growth.

- Sydney offers strong demand, though prices are higher.

- Melbourne remains a hotspot for young professionals and families.

- Regional areas are showing growing opportunities as more people move away from big cities.

By studying each area and comparing returns, you can increase your chances of finding the best property investment loans in Australia and securing the right property. A wise choice today can set you up for long-term wealth in the future.

\Role of a Property Investment Company

When you start in property investment, it can feel overwhelming. However, a property investment company is there to help you with research, strategy, and negotiation. This support saves you time and avoids costly mistakes, making your journey smoother and more rewarding.

By working with experts, you get access to market insights and finance options that are not always easy to find. With the proper guidance, your property journey becomes smoother and more rewarding.

Top 5 FAQs about Property Investment in Australia

1. What is investment in property?

It is buying property to earn rental income or long-term growth.

2. How does property investment work?

You buy a property, rent it out, and benefit from rental income or value growth over time.

3. Is property investment in Australia profitable in 2025?

Yes, demand remains strong, especially in growing cities and regional areas.

4. What is the best location for investment property?

Queensland, Sydney, Melbourne, and regional towns all offer strong opportunities.

5. Do I need a property investment company to succeed?

Although not required, expert support can make the process easier and safer.

Final Thoughts on Successful Property Investment

Property investment in Australia gives you a chance to build wealth and achieve financial stability. With careful planning, research, and wise financial decisions, you can make property work for you.

If you are ready to take the next step, FGS Finance can guide you in securing the right loan and finding the best approach for your investment. Contact us today at 0431 170 021 or email info@fgsfinance.com.au to get started with your property investment journey. We’re here to help you make the most of your property investment in Australia.