Understanding eligibility is essential to secure a Low Doc Loan in Australia. This guide covers key requirements for self-employed individuals, business owners, and property investors. Learn how low doc mortgage brokers simplify the process and connect you with suitable lenders. Explore options including low doc home loans, investment loans, and business loans. FGS Finance guides you step by step to access the right low doc loan and achieve your financial goals.

What is a Low Doc Loan in Australia?

A Low Doc Loan in Australia is designed for borrowers with non-traditional income documentation. This includes self-employed individuals, contractors, and business owners who cannot provide standard payslips or complete tax returns. These loans make borrowing accessible while maintaining lender confidence in repayment capacity.

Options include low doc home loans, low doc investment loans, and low doc business loans. Working with low doc mortgage brokers simplifies lender comparisons and ensures all documentation meets requirements. FGS Finance helps clients prepare accurate applications, select the right loan type, and streamline approval for faster results.

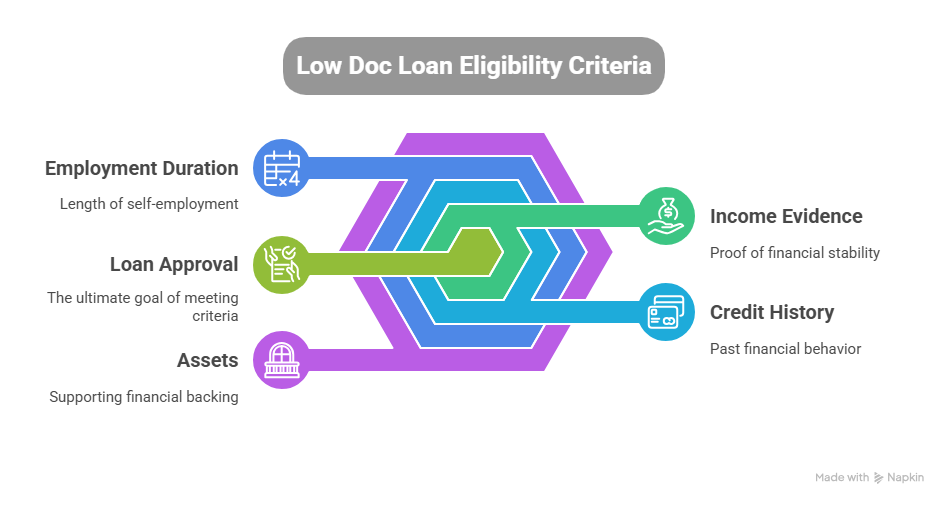

Key Eligibility Criteria for Low Doc Loans

Meeting eligibility requirements boosts approval chances and reduces delays.

- Minimum 12 months of self-employment or contract work.

- Satisfactory credit history with no recent defaults.

- Evidence of income through BAS statements or accountant letters.

- Stable assets or savings to support the loan application.

- Loan amount generally up to 80% of property value, depending on the lender.

FGS Finance reviews eligibility for low doc loans for self-employed clients and investors. Guidance ensures accurate document submission and higher chances of approval for the right low doc loan in Australia.

Advantages of Low Doc Loans

Low doc home loans provide flexibility for borrowers who cannot submit standard payslips. This allows access to property finance without strict documentation requirements.

Low doc investment loans help property investors expand portfolios even with non-standard income. Investors can leverage opportunities in the property market without traditional documentation barriers.

Low doc business loans support small business owners seeking capital for operations or growth. Using low doc mortgage brokers ensures comparison of multiple lenders, competitive rates, and selection of the most suitable loan. FGS Finance assists clients in understanding options, calculating affordability, and submitting applications efficiently.

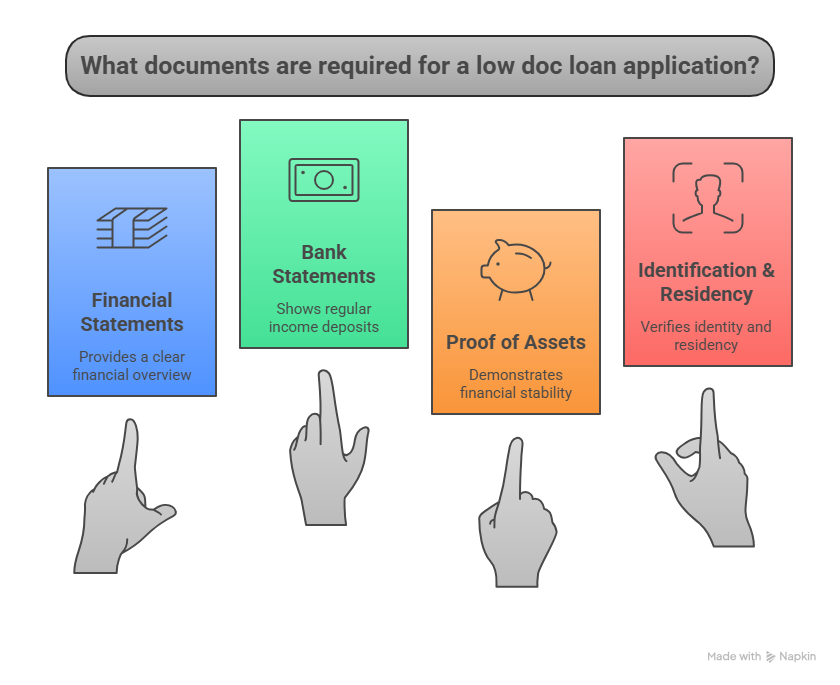

Standard Documents Required for Low Doc Loan Applications

While Low Doc Loan in Australia requires fewer documents, lenders still need evidence to assess income and capacity.

- Accountant-signed financial statements or BAS statements.

- Bank statements showing regular income deposits.

- Proof of assets such as property or savings.

- Identification documents and residency proof in Australia.

FGS Finance helps clients prepare the correct documents and guides them to suitable lenders. Proper preparation increases approval chances and allows borrowers to access low doc home loans, investment loans, or business loans efficiently.

Tips for a Successful Low Doc Loan Application

Keep credit records accurate and up-to-date. Avoid overdue bills and applying for multiple loans at once. Lenders carefully assess credit before approving a Low Doc Loan in Australia.

Work with low doc mortgage brokers to find suitable lenders. FGS Finance evaluates financial profiles, recommends loan types, and ensures documentation accuracy. Expert guidance increases approval chances and helps secure competitive loan options.

Top 5 FAQs

What is a low doc loan in Australia?

A loan for borrowers with non-traditional income, such as self-employed individuals or contractors.

Who can apply for a low doc loan?

Self-employed borrowers, business owners, and property investors are eligible.

Are low doc loans more expensive?

Although rates may be slightly higher, using brokers can help secure competitive deals.

Can I get a low doc investment loan?

Yes, these loans are available for investors with non-standard income.

Do I need a broker to apply?

Brokers simplify the process, compare lenders, and improve approval chances.

Final Thoughts on Low Doc Loans

A Low Doc Loan in Australia provides flexibility for borrowers with non-standard income. Understanding eligibility, preparing documents, and choosing the right loan type improve approval chances and ensure access to suitable finance.

FGS Finance guides clients through eligibility checks, lender comparisons, and application submissions. Contact FGS Finance at 0431 170 021 or email info@fgsfinance.com.au today to start your low doc loan journey and secure the best solution for your financial needs.