Low Doc Business Loans vs Traditional Business Loans: Which is Right for You?

If you run a business in Australia, you may wonder which loan suits you best. Low doc business loans can be a flexible choice if you don’t have full paperwork. Traditional loans need more documents but may offer lower rates. Each option has benefits and risks depending on your situation. This guide explains both choices so you can decide with confidence.

Understanding Low Doc Business Loans

A low doc loan in Australia is designed for business owners and self-employed people who don’t have complete financial records. You may not have recent tax returns or detailed accounts, but you still need finance for growth. These loans are popular with small business owners, freelancers, and startups.

Unlike a standard loan, a low doc option uses alternative proof such as bank statements, BAS, or a signed accountant’s letter. This makes the process faster and easier. Many people also explore related products like low doc home loans and low doc investment loans.

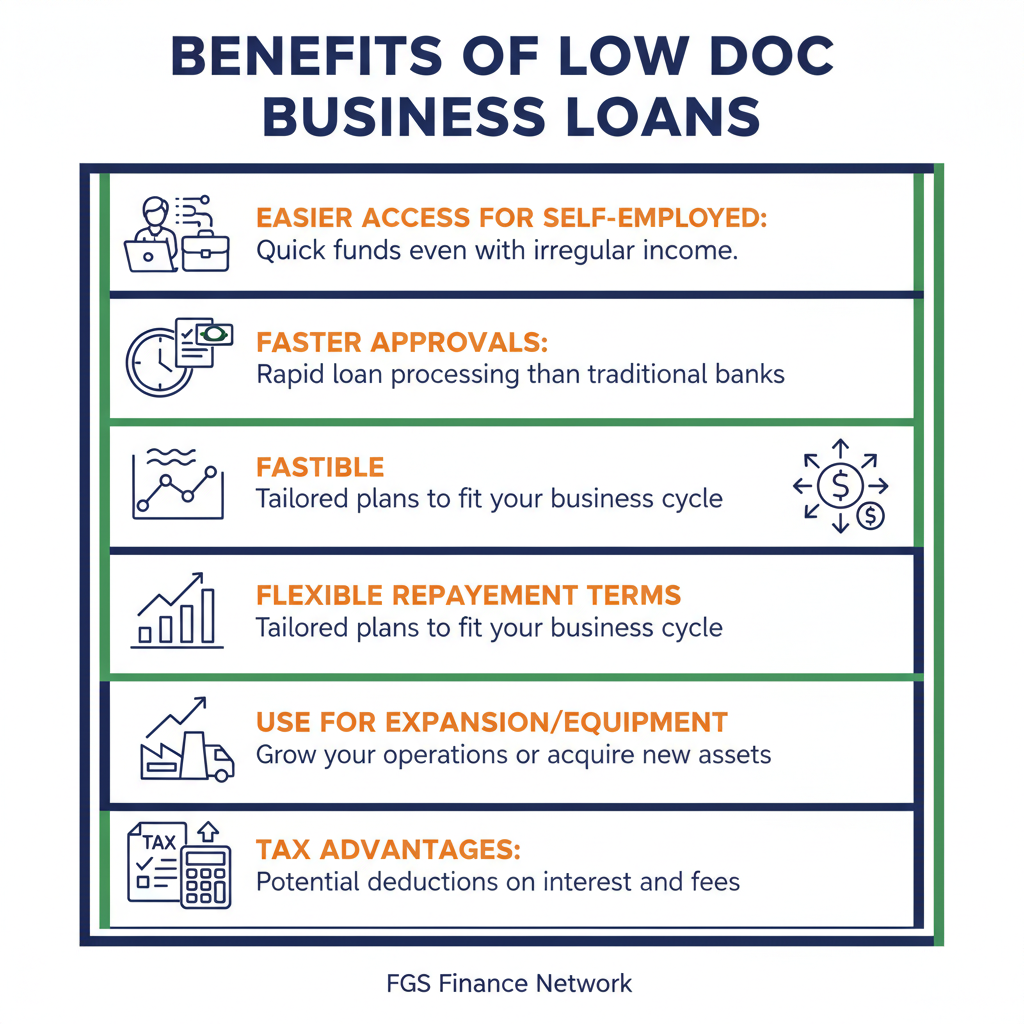

Benefits of Low Doc Business Loans

A low doc business loan can give you more freedom when you need funds. Here are some of the main benefits:

- Easier access if you are self-employed with irregular income

- Faster approvals compared to traditional loans

- Flexible repayment terms that suit your cash flow

- Useful for expansion, vehicles, or new equipment

- Possible tax advantages depending on how you use the funds

Drawbacks and Risks of Low Doc Business Loans

Low doc loans also come with challenges. Interest rates are usually higher than a traditional loan. That means your repayments may be more expensive over time.

You may also face tighter conditions. Lenders often ask for a bigger deposit or personal guarantee. This reduces risk for the lender but increases yours.

The long-term costs can add up. It’s smart to compare lenders and seek advice from low doc mortgage brokers before you decide. The right choice can protect your business in the future..

Traditional Business Loans Explained

Traditional business loans are the standard product many companies use. They need full documentation and a clear financial record.

- You must provide tax returns and financial statements

- Interest rates are usually lower than low doc options

- You can borrow larger amounts depending on your turnover

- Best for established businesses with steady income

This option works well if your accounts are in order. If you can show stable cash flow, a traditional loan may be the most cost-effective way to finance growth.

Which Loan Option is Right for You?

Both options have clear roles. Low doc loans for self-employed people provide flexibility. Traditional loans support stable, established businesses with full paperwork.

Your choice depends on your current position and your goals. Think about your income, your risk level, and how fast you need the funds.

FAQs About Low Doc Business Loans in Australia

1. What is a low doc loan in Australia?

It’s a loan for people without full financial documents. You can use bank statements, BAS, or accountant letters instead.

2. Are low doc business loans only for self-employed?

No. They suit self-employed people best, but small business owners without complete records can also apply.

3. How do low doc home loans differ from low doc business loans?

A low doc home loan is for buying a property. A low doc business loan funds your business needs like equipment or expansion.

4. Can I get a low doc investment loan for property?

Yes, many lenders offer low doc investment loans. They allow you to buy or refinance an investment property with limited paperwork.5. Do I need a mortgage broker for a low doc loan?

A broker can help. They know lenders, compare options, and save you time. It can also improve your chances of approval

Both low doc and traditional loans can be powerful tools. If you lack paperwork, low doc options may give you the freedom you need. If your accounts are strong, traditional loans could save you money.At fgsfinance, we make loan options simple. Our team helps you choose the right product for your needs. Call us today at 0431 170 021, email info@fgsfinance.com.au, or visit us at 15 Abbeywood Street, Taigum QLD 4018. Let fgsfinance guide your business toward the best finance solution.