Securing a Franchisee Business Loan is essential for growing or starting your franchise in Australia. Understanding lender requirements can improve your approval chances. This guide explains key eligibility criteria, common mistakes, and expert tips. Learn how to prepare a strong application and maximize success. FGS Finance, a leading finance provider, offers personalized support to help franchise owners get the right loan, from initial consultation to final approval.

Understanding Franchisee Business Loans

A Franchisee Business Loan is a specialized financing option designed for franchise owners in Australia. It’s crucial to understand that, unlike standard business loans, this loan type takes into account the unique structure of franchise operations. It supports start-ups and established businesses to cover costs such as equipment, working capital, and expansion.

Lenders focus on both your personal financial health and the franchise model’s stability. With proper planning, you can secure funds at competitive rates. FGS Finance helps applicants navigate the process, ensuring applications are complete and accurate. Using the right approach increases your chances of approval and reduces delays.

Key Eligibility Criteria for Lenders

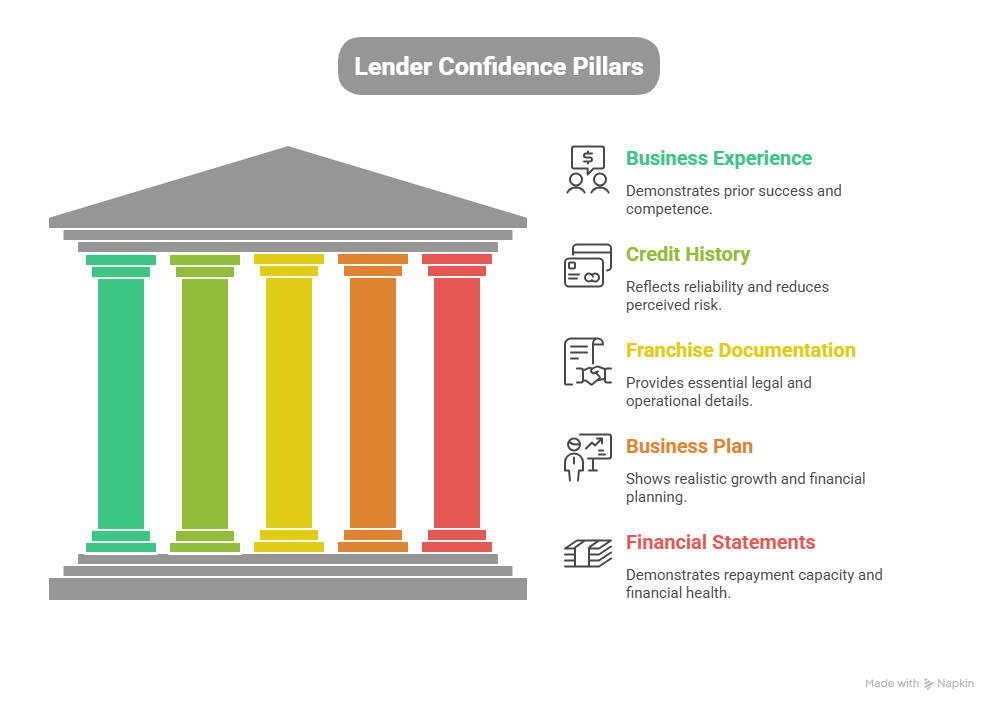

When applying for a franchisee business loan Australia, lenders assess multiple factors to determine approval.

- Proven business experience: Demonstrating prior success or relevant experience increases lender confidence.

- Strong credit history: A solid record reflects reliability and reduces perceived risk.

- Franchise documentation: Providing signed agreements and franchise details is essential.

- Business plan & revenue projections: Showing realistic growth and financial planning supports your request.

- Financial statements: Personal and business statements demonstrate repayment capacity.

Meeting these criteria positions you as a responsible borrower. Preparing these documents in advance simplifies the process and speeds approval. With FGS Finance by your side, you can be confident that your application will be professionally handled and meet lender expectations.

How Lenders Evaluate Your Application

Lenders review applications to assess risk and repayment ability. They examine cash flow, profitability, and current financial obligations. Understanding your franchise’s market position is also crucial.

For start-up franchises, lenders pay attention to projected income and growth potential. Established franchisees benefit from showing consistent revenue and operational efficiency.

Lenders prefer franchises with proven models and strong brand presence. Providing accurate, complete documentation signals reliability. With FGS Finance, your application reflects professionalism and meets lender expectations.

Tips to Improve Your Loan Approval Chances

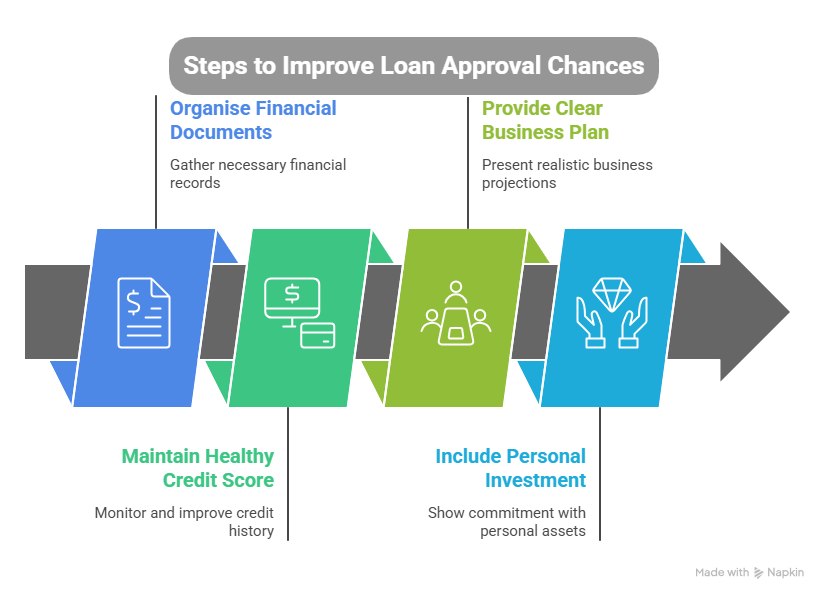

Preparing a complete, well-documented application enhances success. FGS Finance recommends the following key steps when seeking a business loan for franchisee:

- Organize financial documents: Include tax returns, bank statements, and asset records.

- Maintain a healthy credit score: Regularly monitor and address any issues before applying.

- Provide a clear business plan: Show realistic revenue projections and operational goals.

- Include personal investment or collateral: Demonstrates commitment and lowers lender risk.

Following these steps makes lenders more confident and reduces processing time. FGS Finance helps streamline the process and ensures every detail is correct.

Common Mistakes to Avoid

Avoiding common errors is crucial to strengthening your application. Submitting incomplete forms or ignoring lender requirements can lead to rejection. Overestimating income or providing unrealistic projections reduces credibility. It’s important to always use accurate financial data. Transparency builds trust with lenders and can expedite approval. Working with FGS Finance ensures your application is complete and professionally presented.

Always use accurate financial data. Transparency builds trust with lenders and can expedite approval. Working with FGS Finance ensures your application is complete and professionally presented.

Top 5 FAQs on Franchisee Business Loans in Australia

1. What is a franchisee business loan?

It’s a loan to fund franchise operations, including start-up or expansion costs.

2. Who can apply for a franchisee loan in Australia?

Both new and established franchise owners with proper documentation and financial stability.

3. Do I need a franchise agreement to apply?

Yes, lenders require a signed agreement as part of the application.

4. Can first-time franchisees get approved?

Yes, with strong financial records and a solid business plan.

5. How long does approval take?

Typically 1–4 weeks, depending on documentation and lender requirements.

Why Work with FGS Finance

FGS Finance specializes in helping franchise owners secure the right Franchisee Loan. The team provides personalized guidance, ensures complete applications, and enables you to find the best rates.

With FGS Finance, you can confidently navigate the process, save time, and focus on growing your franchise. Contact FGS Finance at 0431 170 021 or info@fgsfinance.com.au to start your application today.