Buying your first home in Australia can feel overwhelming. Home buyers in Australia face many choices and financial decisions. Using AI tools can make property search and loan selection easier. Understanding home loans, government schemes, and costs is vital. This guide helps first-time buyers make smart, informed decisions with confidence.

Understanding the Australian Home Buying Process

Buying your first home in Australia starts with research. You need to know your budget and loan options. Home buyer finance in Australia can vary, so comparing lenders is important. AI tools can help you find properties that match your needs quickly.

Next, consider hidden costs like inspections, legal fees, and insurance. Understanding these ensures you avoid surprises. First Home Owner finance programs can help reduce your upfront costs. Planning carefully makes your journey as a first-time buyer smooth. FGS Finance provides guidance to navigate each step efficiently.

Key Tips for First-Time Home Buyers

Being prepared helps you save money and avoid mistakes. Here are essential tips for first-time home buyers in Australia:

- Check your credit score and improve it before applying.

- Compare different home loans and interest rates.

- Explore government schemes like the First Home Guarantee.

- Save for deposits, fees, and unexpected costs.

- Seek advice from finance experts or mortgage brokers.

Following these tips increases your chances of approval. Using FGS Finance ensures access to the best options and guidance throughout your journey.

Home Buyer Finance Options in Australia

There are several financing options for first-time buyers. Conventional home loans offer predictable payments. Low doc loans are ideal if your income is irregular or if you are self-employed. Investment loans provide opportunities if you plan to grow your property portfolio.

Programs like the First Home Guarantee reduce deposit requirements. These initiatives make buying your first property easier. First Home Owner finance can help you enter the property market without major financial stress.

Choosing the right loan depends on your income, budget, and long-term goals. FGS Finance helps you select the best option, ensuring smart and secure financial decisions. Working with experts reduces risk and simplifies the process.

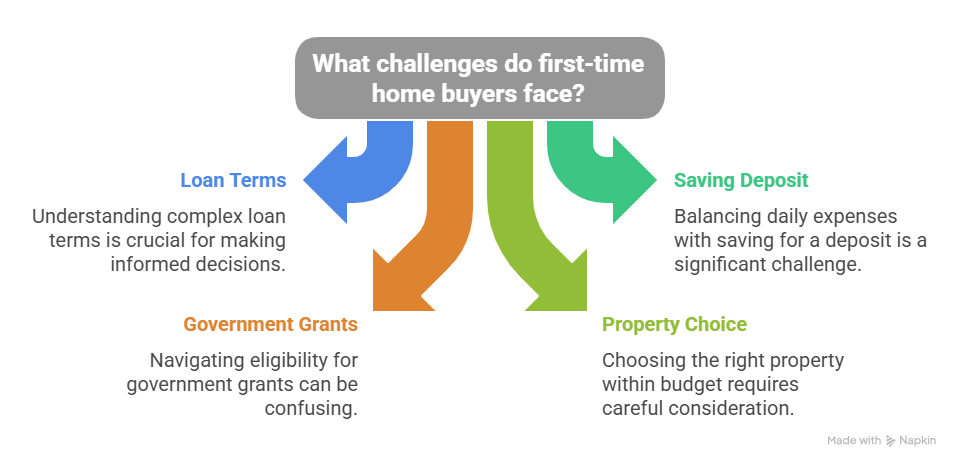

Common Challenges First-Time Home Buyers Face

Buying a home for the first time can be challenging. Being aware of obstacles helps you prepare.

- Understanding complex home loan terms.

- Saving enough deposit while managing daily expenses.

- Navigating government grants and eligibility.

- Choosing the right property within budget.

Knowing these challenges lets you plan better. FGS Finance guides first-time buyers to overcome obstacles efficiently. Preparing in advance reduces stress and ensures smooth property ownership.

How AI is Helping First-Time Home Buyers in Australia

AI technology makes property search easier and faster. Tools like mortgage calculators and comparison platforms provide tailored advice. We analyze your budget and suggest suitable loans.

AI can predict property trends and estimate future values. This allows home buyers in Australia to make informed investment decisions. Using AI alongside expert guidance from FGS Finance ensures smarter, faster, and more confident choices.

FAQs for First-Time Home Buyers

What is the First Home Guarantee in Australia?

The First Home Guarantee helps first-time buyers purchase property with a lower deposit. It reduces upfront costs and eases financial stress.

How much deposit do I need to buy my first home?

Typically, you need 5–20% of the property price. Programs like the First Home Guarantee lower this requirement for eligible buyers.

Can I get a low-doc loan as a first-time buyer?

Yes, low doc loans are ideal for self-employed buyers or those with irregular income. They require fewer documents than standard loans.

Do I need a mortgage broker?

While not required, brokers help first-time buyers compare loans and find better rates. FGS Finance provides expert support throughout the process.

What hidden costs should I plan for?

Include stamp duty, legal fees, inspections, insurance, and moving costs. Preparing for these ensures a smooth home-buying experience.

Conclusion & Call to Action

Being informed about home buyer finance in Australia, government schemes, and AI tools simplifies your first home purchase. Following tips and understanding options reduces stress and saves money.

Contact FGS Finance today for personalized guidance. FGS Finance helps first-time home buyers in Australia find the best loans, compare options, and make confident financial decisions. Call 0431 170 021 or email info@fgsfinance.com.au to start your home ownership journey.