Managing your business finances can be challenging, especially when cash flow is tight. Cash flow lending provides a fast and practical solution for businesses needing working capital. Understanding how lenders evaluate applications can help you secure funding quickly. This guide offers actionable tips, common mistakes to avoid, and strategies to get approved faster. Whether you run a small business or a growing enterprise, learning about business cash flow lending in Australia will strengthen your financial management.

Understanding Cash Flow Lending

Cash flow lending is a type of finance that helps you cover short-term business expenses. It allows your business to access working capital without waiting for invoices or sales revenue. These loans are ideal for small to medium businesses in Australia.

Lenders assess your ability to repay based on current revenue, business performance, and projected cash flow. Options include cash flow loans for small business, revolving credit facilities, and unsecured loans. FGS Finance guides you through the process and ensures your application meets lender expectations for fast approval.

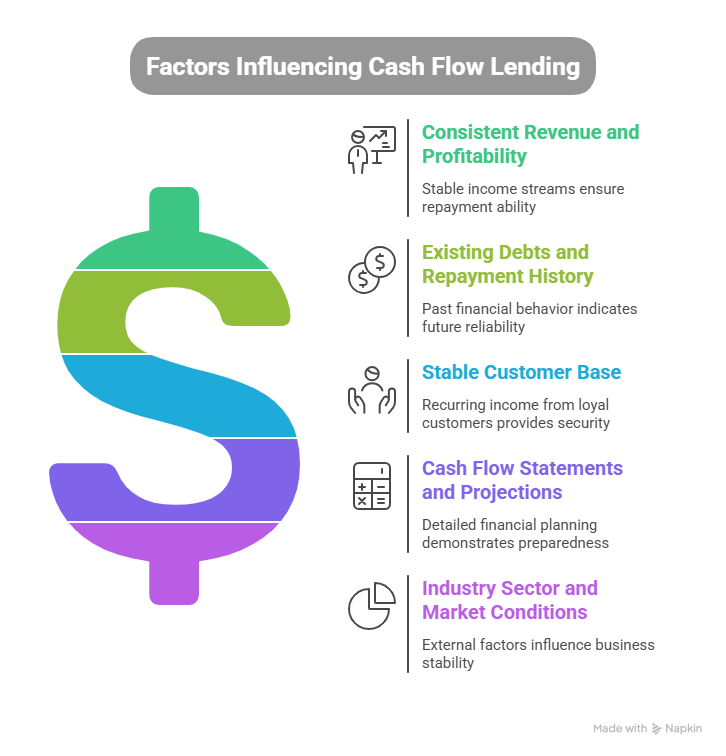

Key Factors Lenders Consider for Cash Flow Lending

Before applying, you need to understand what lenders look for. This knowledge increases your approval chances.

- Consistent business revenue and profitability

- Existing debts and repayment history

- Stable customer base with recurring income

- Detailed cash flow statements and future projections

- Industry sector and market conditions

Preparing these elements properly strengthens your business cash flow loan application. FGS Finance helps you organize financial records and present them clearly, improving your chances of securing funding quickly and easily.

How to Prepare Your Business for Cash Flow Lending

Organizing your financial documents is the first step to getting approved. Lenders require clear statements showing your business income, expenses, and liabilities.

Demonstrating consistent revenue reassures lenders about repayment ability. Include accurate cash flow forecasts to show your business can manage loan obligations.

FGS Finance works with you to refine documents, ensure accuracy, and highlight financial stability. With proper preparation, your application becomes stronger, and lenders process approvals faster. Professional guidance saves time and reduces errors that can delay funding.

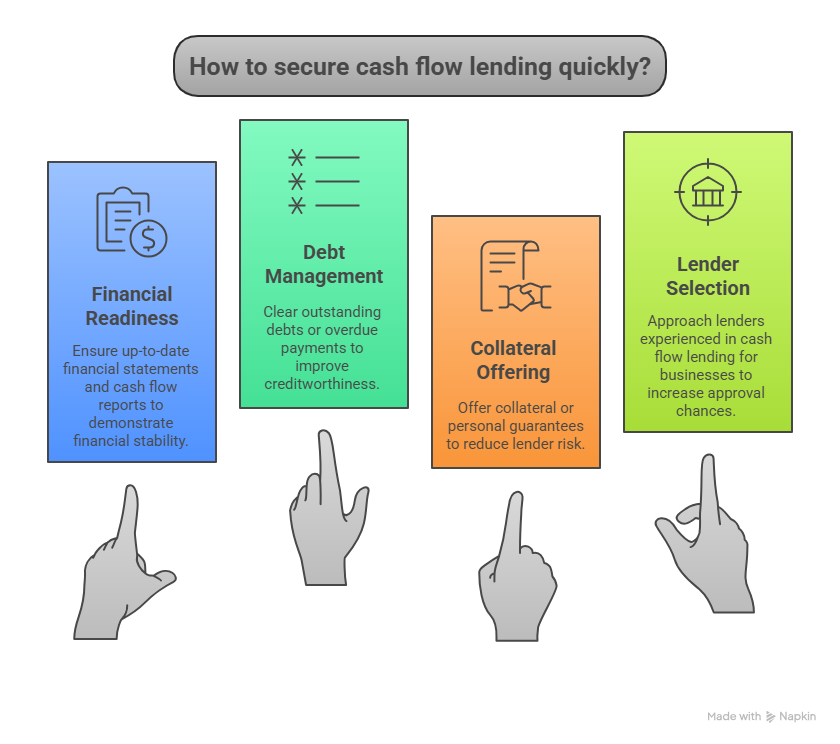

Practical Tips to Secure Cash Flow Lending Quickly

Speed and accuracy matter when applying for business cashflow loans. Follow these strategies to improve approval chances:

- Keep up-to-date financial statements and cash flow reports.

- Clear outstanding debts or overdue payments before applying

- Offer collateral or personal guarantees if needed.

- Approach lenders experienced in cash flow lending for businesses.

Implementing these steps ensures your application is complete and credible. FGS Finance helps you prepare all documents correctly, presenting a strong case for approval. Quick access to funds enables you to maintain operations and invest in growth opportunities confidently.

Common Mistakes to Avoid

Incomplete documentation can delay loan approval. Weak cash flow projections or unclear financial records reduce trust.

FGS Finance ensures your business cash flow lending application is accurate and organized. Avoiding mistakes like missing statements, underestimating repayments, or ignoring lender criteria improves the likelihood of quick funding. Proper preparation simplifies the approval process and allows you to access cash when your business needs it most.

Top 5 FAQs About Cash Flow Lending

- What is cash flow lending?

A loan designed to help businesses manage short-term expenses using projected cash flow.

- Who can apply for business cash flow loans?

Small and medium businesses with documented income and financial statements can apply.

- How quickly can cash flow loans be approved?

Approval generally takes a few days to a few weeks, depending on documentation.

- Do I need collateral for cash flow lending?

Some loans require collateral, while others offer unsecured options based on cash flow strength.

- Can self-employed or low-documentation businesses apply?

Yes. Many lenders provide options tailored to self-employed or low-documentation applicants.

Conclusion

Cash flow lending provides essential support for businesses managing short-term expenses. Preparing financial statements, understanding lender criteria, and avoiding common mistakes increase approval speed.

FGS Finance assists you in every step, from evaluating eligibility to submitting applications. Accessing business cashflow loans becomes simpler and faster with expert guidance. Contact FGS Finance today to secure the funding your business needs. Call 0431 170 021 or email info@fgsfinance.com.au.