Cash Flow Finance Australia vs Traditional Business Loans: Which is Better?

Cash flow finance Australia helps businesses manage money fast and easily. It offers quick access to funds without complex processes. Traditional business loans require more time and collateral. Many Australian businesses prefer flexible options for daily operations. This guide helps you choose the right finance solution for your business needs.

What is Cash Flow Finance in Australia?

Cash flow finance Australia provides funding based on your business income. Unlike traditional loans, it focuses on future cash inflows. Businesses can access money to cover payroll, supplies, or short-term needs. It is ideal for small and medium enterprises in Queensland and across Australia.

Cash flow lending for businesses allows fast approval with less paperwork. You don’t need heavy collateral or complex credit checks. Many entrepreneurs choose business cash flow loans to keep operations smooth. At fgsfinance, this service is designed to help businesses grow without financial stress.

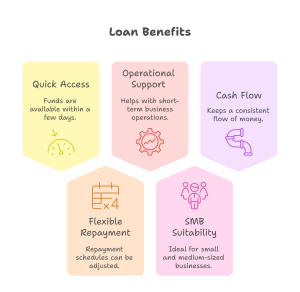

Key Features of Cash Flow Loans

Cash flow loans are simple and flexible. Businesses of any size can benefit.

- Quick access to funds within days

- Flexible repayment schedules

- Supports short-term operational needs

- Suitable for small and medium businesses

- Maintains steady cash flow

These features make cash flow loan a popular choice in Australia. Fgsfinance provides tailored solutions to match your business requirements. Business cashflow lending becomes easier with expert guidance and local knowledge.

Traditional Business Loans Explained

Traditional business loans are structured and long-term. So we usually need collateral and extensive paperwork. Businesses often face longer approval times compared to cash flow finance.

The main advantage is lower interest rates. Payments are predictable and planned over months or years. Traditional loans suit businesses investing in fixed assets or expansion projects.

However, these loans may not cover immediate operational needs. Fast financing is harder with standard approvals. Commercial cash flow lending remains a faster option for daily business expenses.

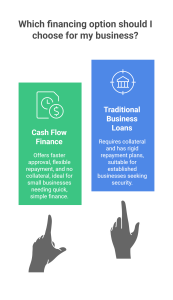

Cash Flow Finance vs Traditional Business Loans

Choosing the right finance depends on your business needs. Here is a comparison:

- Speed of Approval: Cash flow loans are faster. Traditional loans take weeks.

- Repayment Flexibility: Cash flow lending offers adaptable plans. Traditional loans are rigid.

- Collateral Requirements: Cash flow finance often needs none. Traditional loans require security.

- Business Suitability: Small businesses benefit from cash flow loans. Established businesses often prefer traditional loans.

For businesses needing fast, simple finance, cashflow finance Australia is a better choice. Fgsfinance provides expert guidance and personalized solutions for all business sizes.

How to Apply for Cash Flow Finance in Australia

Applying for cash flow loans for small business is simple. First, gather financial statements and business details. Business cash flow lending requires basic verification of income.

Submit an application online or contact fgsfinance directly. Experts review the cash flow and provide fast approval. Tips to improve approval include accurate records and clear business plans. This ensures your business cashflow loan is smooth and quick.

FAQs About Cash Flow Finance in Australia

- What is cash flow finance in Australia?

Cash flow finance is funding based on your business’s future income. It helps you cover short-term operational costs quickly and keeps your business running smoothly. - How is it different from traditional business loans?

Cash flow loans are faster and need less paperwork. Traditional loans often require collateral and have longer approval times. - Who can apply for a cash flow loan?

Small and medium businesses can apply, including startups with steady cash flow. Lenders assess your revenue rather than assets. - How quickly can funds be accessed?

Funds are often available within a few days. This allows you to handle urgent expenses without delays. - Is cash flow finance suitable for all businesses?

It works best for day-to-day operations and short-term needs. Long-term investments or large assets may require traditional loans.

Cash flow finance Australia is ideal for businesses needing quick and flexible funds. Traditional loans suit long-term, structured financial goals. Fgsfinance helps you assess the best option. You can secure funding fast with personalized solutions.

Contact FGS Finance today at 0431 170 021 or email info@fgsfinance.com.au. Let our experts guide your business toward growth with the right cash flow lending solution. Your business success is our priority.