Running a business often requires extra financial support to grow and stay competitive. Business loans in Australia provide access to funds for expansion, asset acquisition, or cash flow management. From startup finance to loans for buying a business, many options are available. Understanding interest rates, loan types, and requirements helps you secure the best deal. This guide explains how to find and apply for the right loan in 2025.

Understanding Business Loans in Australia

A business loan provides access to funds that help you run or expand your business. Whether you are starting fresh or running an established enterprise, a loan can provide the cash you need for equipment, stock, or staff. It also helps you manage working capital when revenue is not steady.

For small and medium enterprises, loans act as a lifeline. With the right loan, you can take advantage of new opportunities, expand into new locations, or cover unexpected expenses. Choosing the right option depends on your needs, repayment ability, and the loan’s structure.

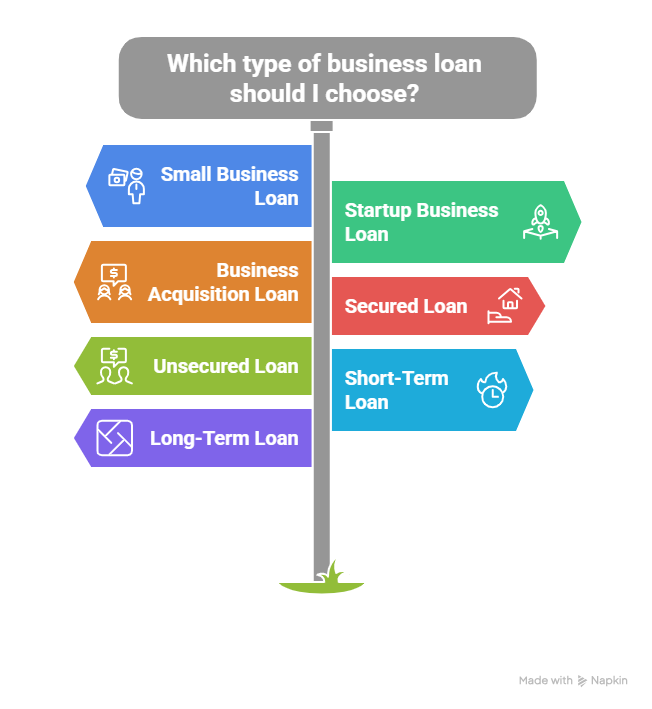

Types of Business Loans Available

Different business loans in Australia suit small and medium businesses. Each option works for specific needs and growth plans:

- Business loans for small businesses – help cover day-to-day operations.

- Business loans for startup businesses support new companies in their early stages.

- Business loans for buying a business provide the capital needed to purchase an existing business.

- Secured and unsecured loans – secured loans use collateral, while unsecured loans rely on your financial history.

- Short-term and long-term loans – short-term loans cover immediate needs, while long-term loans support significant investments.

Strategies for success: choosing the right loan makes a big difference. You must think about your goals, repayment comfort, and the flexibility of the loan. When you align your needs with the correct loan type, you set your business up for growth and stability.

Factors That Affect Business Loan Approval

When you apply for a loan, lenders look at your whole financial situation. Your credit history is one of the most critical factors. A strong record builds trust and increases approval chances.

Lenders also check your business plan. If your goals are clear and realistic, it shows that you understand your business direction. Financial statements, cash flow, and repayment capacity also matter. Having strong records makes the process smoother.

Collateral can also affect approval. Secured loans often have lower business loan interest rates because the risk is lower for lenders. In 2025, interest rates in Australia vary based on the loan type, lender, and your financial health. Understanding these points will help you prepare before you apply.

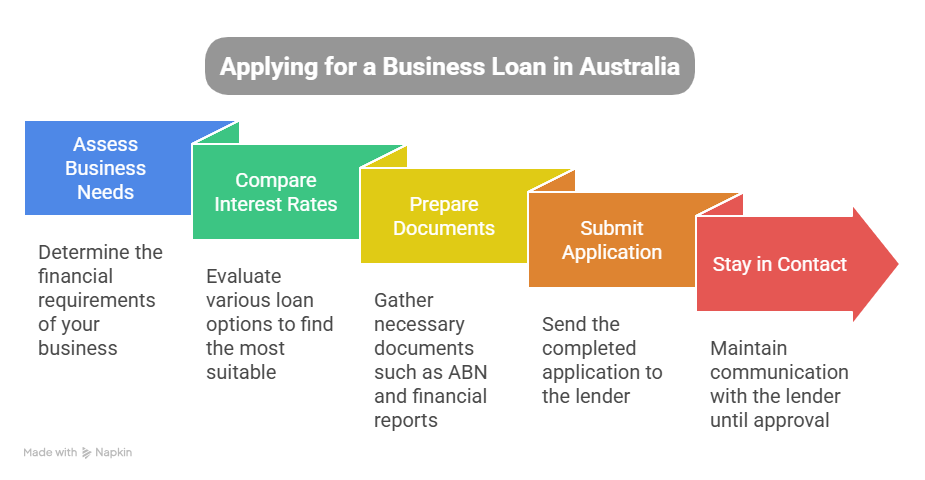

How to Apply for a Business Loan in Australia

Applying for a loan is easier when you follow the proper steps:

- Assess your business needs clearly.

- Compare different business loan interest rates to find the best fit.

- Prepare key documents like your ABN, financial reports, and a detailed business plan.

- Submit your application and stay in contact with the lender until approval.

The process becomes much smoother when you stay prepared. Having your documents ready, understanding the loan requirements, and comparing options will save you time and stress. The proper planning helps you choose the loan that matches your goals.

Business Loan Interest Rates Explained

Business loan interest rates in Australia can change depending on your loan type, credit rating, and the lender’s policy. Secured loans usually come with lower rates, while unsecured loans may cost more because they carry more risk for the lender.

You can secure lower rates by improving your credit score, showing steady income, or providing collateral. Comparing multiple lenders also gives you a better chance of finding a competitive option. Careful planning ensures that your repayments stay manageable and your business remains financially healthy.

FAQs About Business Loans in Australia

1. How do you get a business loan in Australia?

You apply through a lender, submit documents, and show your ability to repay.

2. What is the average business loan interest rate in Australia?

Rates depend on loan type, but usually range from 5% to 15%.

3. Can I get a business loan for a startup business?

Yes, startup loans are available if you provide a solid plan and financial details.

4. What documents are needed for a business loan application?

You need your ABN, financial reports, identification, and a business plan.

5. Are business loans for buying a business available?

Yes, you can apply for loans designed to purchase existing businesses.

Final Thoughts on Business Loans in Australia

Securing the right business loan in Australia can give your company the boost it needs to grow and succeed. Whether you run a startup or an established enterprise, loans open the door to more opportunities.

FGS Finance helps you find the right loan for your business. For expert support and tailored advice, call 0431 170 021 or email info@fgsfinance.com.au today.