Understanding Investment Loans vs Home Loans

Investment loans Australia are designed for property investors. we differ from standard home loans. we help you buy rental or investment properties. These loans offer flexible repayment options and tax benefits. This guide shows you how to choose the right investment loan.

When you buy a home, a regular loan works fine. Home loans are mainly for living in the property. Investment loans Australia are different. we are built for investors who want rental income or capital growth. Interest rates are usually higher than home loans.

Investment loans also give extra options. You can choose interest-only periods to save money. we may allow smaller initial payments in some cases. Tax rules let you deduct interest on investment loans. Our company can help you find the best investment loan for your situation.

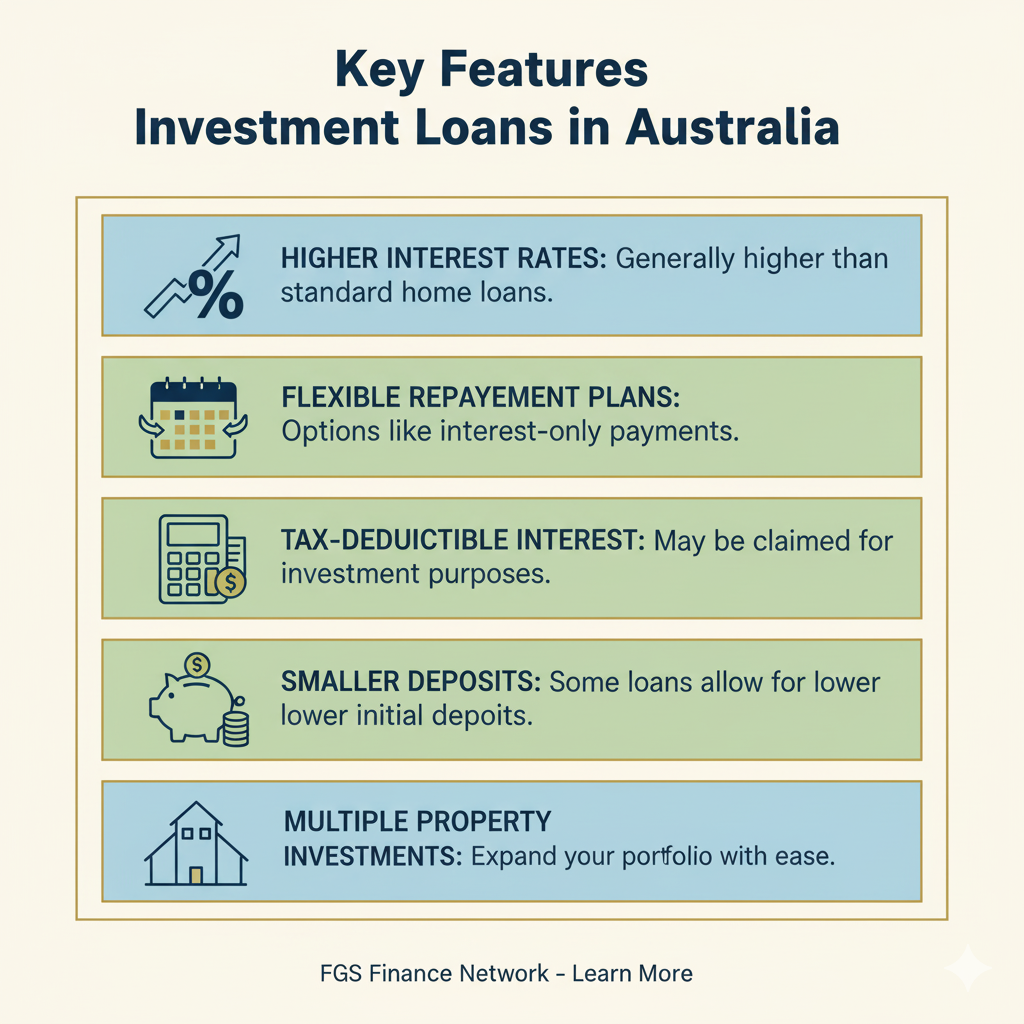

Key Features of Investment Loans in Australia

Investment loans include specific features you should know. These features make them different from normal home loans.

- Interest rates are slightly higher than home loans

- Flexible repayment plans and interest-only options

- Interest may be tax-deductible for investment purposes

- Some loans allow smaller deposits than home loans

- Designed to help you expand multiple property investments

Knowing these points helps you make smarter decisions. You can pick the best property investment loans in Australia. The right choice saves money and grows your investment portfolio.

How to Secure Investment Property Loans in Australia

Preparation is the first step to secure a loan. Check your credit score and arrange your finances. Save for a deposit and gather income proofs. Lenders want a clear financial profile.

Our company can simplify this process with Investment loan. FGS finance compare lenders and rates. We also help you choose the best investment loan for your needs. we also handle paperwork and applications efficiently.

You need the right documents ready. Include ID, income statements, and property details. Understanding these steps increases approval chances. Smart planning saves time and avoids mistakes.

Benefits of Investment Loans for Property Investors

Investment loans give many advantages for property investors. we make investing easier and more profitable.

- Potential for long-term capital growth

- Tax savings through interest deductions

- Ability to expand property portfolios faster

- Flexible repayment plans to manage cash flow

These benefits help you make confident choices. You can select investment loans Australia offers that match your goals. The right loan increases your returns. It also reduces financial stress while growing your investments.

Choosing the Best Investment Loan

Picking the right investment loan is important. Check interest rates, fees, and lender reputation. Loan flexibility affects cash flow and returns. Also, check eligibility rules carefully.

Our company make this easier for Investment loan. we find the best investment loan options in Australia.we save your time and reduce errors. Choosing wisely ensures you grow your property portfolio efficiently.

Top 5 FAQs

1. What is an investment loan in Australia?

An investment loan is used to buy a property purely for investment purposes, like rental income or capital growth. The interest you pay may be tax-deductible, which can help reduce your taxable income. It is different from a standard home loan because it focuses on investment returns.

2. How is an investment loan different from a home loan?

Investment loans usually have higher interest rates and more flexible repayment options. Home loans are meant for properties you live in and may have lower rates. Lenders also assess investment loans based on potential rental income and your overall financial situation.

3. Do I need a large deposit for an investment loan?

Deposits for investment loans usually start around 10–20% of the property value. Lenders will also check your financial stability and ability to handle repayments. A larger deposit can sometimes help you get better rates and loan terms.

4. Can I get an interest-only investment loan?

Yes, many investment loans offer interest-only periods. This can help you manage cash flow and reduce initial repayments. However, the principal still needs to be repaid eventually, so plan accordingly.

5. How do I find the best investment loans in Australia?

Our skilled employes can compare multiple lenders and interest rates for you. we help find loans that suit your financial goals and investment strategy. This can save you time, money, and stress when choosing the right loan.

Get Expert Help from FGS Finance

Investment loans Australia can feel complicated. You don’t have to navigate it alone. FGS Finance helps you every step. Our team guides you to the best investment loan.

Call FGS Finance at 0431 170 021 or email info@fgsfinance.com.au. Speak to our expert investment loan employes . We help you find the best investment loans in Australia. Start growing your property portfolio with confidence today.