If you have multiple debts, a personal loans Australia can simplify your finances. It helps you combine several debts into a single repayment. Low interest personal loans make it easier to manage payments. Choosing the right loan saves money and stress. FGS Finance can guide you to the best solution for your financial goals.

What Are Personal Loans in Australia?

A personal loan in Australia is a fixed amount of money you borrow from a lender. You repay it in regular installments over a set term. Interest rates vary based on your credit score and lender. Low interest personal loans can reduce the overall cost of borrowing.

You can use the loan for many purposes, including debt consolidation. Combining debts into a single payment helps you manage finances better. Personal loans Australia allow flexibility and predictable repayment schedules. FGS Finance offers guidance to find the right loan for your needs.

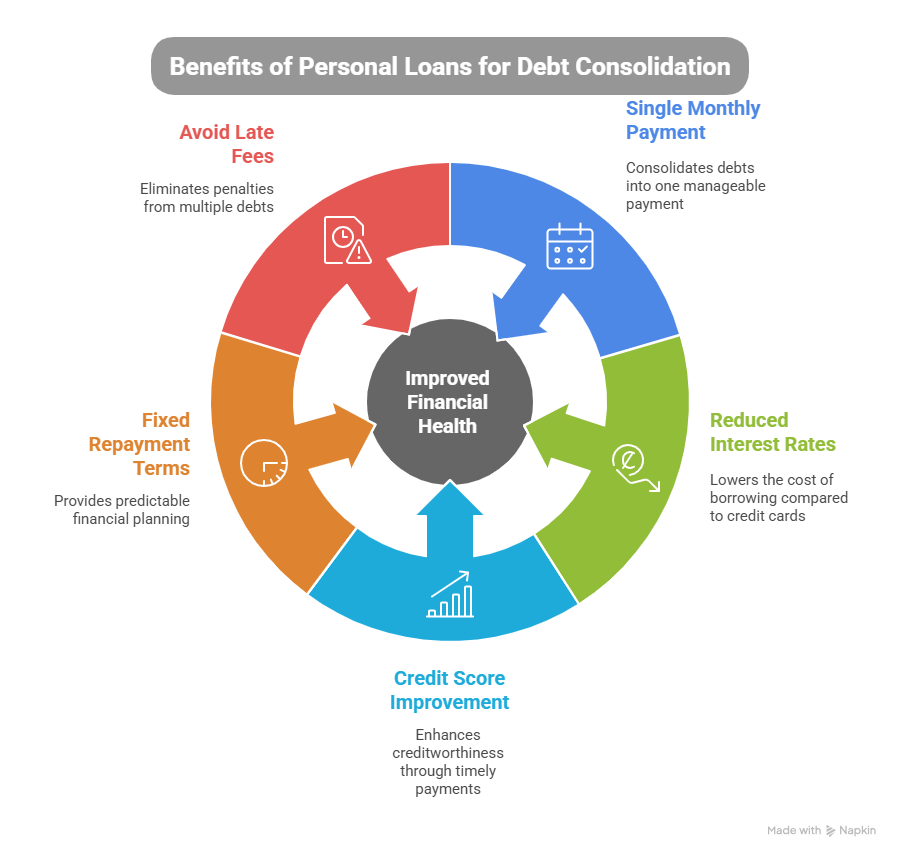

Benefits of Using Personal Loans for Debt Consolidation

A personal loan in Australia can improve your financial health. Here’s why it might be a good option:

- Combine multiple debts into a single monthly payment.

- Reduce interest rates compared to credit cards.

- Improve your credit score with timely payments.

- Plan your finances with fixed repayment terms.

- Avoid late fees from multiple debts.

Using personal loans in Australia for debt consolidation can simplify life. It helps you focus on saving and reducing financial stress. FGS Finance provides support to ensure you choose the right loan.

Risks and Considerations Before Applying

Before taking a personal loan in Australia, assess your situation carefully. Interest rates may vary depending on your credit score. Missing payments can increase debt and harm your credit. Fees may apply for early repayment or late payments.

A personal loan works best if you avoid taking on new debt. Make a budget and ensure the monthly repayments are affordable. Personal loan brokers at FGS Finance can guide you to loans with low interest and flexible terms. Proper planning reduces risk and ensures your debt consolidation is successful.

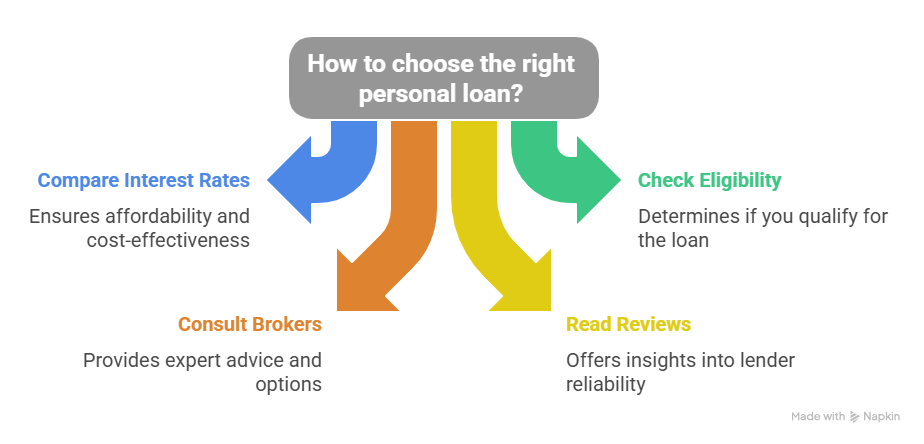

How to Choose the Right Personal Loan for Debt Consolidation

Choosing the right personal loan in Australia is crucial for financial success. Consider these steps:

- Compare interest rates and loan terms.

- Check eligibility and required documents.

- Consult personal loan brokers for advice.

- Read reviews and understand lender policies.

Selecting the right loan ensures lower costs and more manageable repayments. FGS Finance helps Australians find the best loans. Their guidance simplifies the process and saves time.

Steps to Apply for a Personal Loan in Australia

Applying for a personal loan in Australia is straightforward. First, gather your documents, like income proof and ID. Check your eligibility before submitting an application.

Submit your loan request online or through a personal loan broker. FGS Finance ensures quick approval and minimal documentation. Once approved, the funds are deposited directly into your account. Using a trusted company makes the entire process smooth and secure.

Top 5 FAQs About Personal Loans for Debt Consolidation

1. What is the minimum credit score required for a personal loan in Australia?

Most lenders typically require a credit score above 600. However, FGS Finance can guide you even if your score is lower. We help assess your options and find a suitable loan.

2. Can I use a personal loan to pay off credit card debt?

Yes, using a personal loan for debt consolidation is common. It can reduce high-interest payments and simplify your monthly bills.

3. How long does it take to get approved?

Approval usually takes between 24 and 72 hours. FGS Finance works to speed up the process and keeps you informed throughout.

4. Are there any hidden fees with personal loans?

Some loans may have early repayment or processing fees. FGS Finance ensures complete transparency so you know all costs upfront.

5. Should I consult a personal loan broker before applying?

Yes, brokers can help you find the best interest rates and loan terms. FGS Finance offers expert guidance to make the process smoother and easier for you.

Why Choose FGS Finance for Your Personal Loan

FGS Finance specializes in personal loans Australia. We offer flexible options for debt consolidation. Low documentation and quick approval make the process easy. Their experts guide you to the loan that fits your budget and goals.

Contact us FGS Finance today at 0431 170 021 or info@fgsfinance.com.au. Visit fgsfinance.com.au to start your debt consolidation journey. Secure your financial future with trusted support from FGS Finance in Taigum, Queensland.