Managing a property development project requires careful planning and proper funding. Development loans in Australia provide the capital needed to turn ideas into reality. Understanding the loan process and real-life experiences is crucial as it empowers you to make informed decisions. This guide shares stories of successful projects and practical tips for approval and completion. Discover how residential development loans, commercial development loans, and construction development loans can efficiently support your property ventures.

Understanding Development Loans in Australia

A development loan in Australia is a finance solution designed to fund property projects from purchase to completion. These loans cover costs such as land acquisition, construction, and project management. Developers can use residential development loans for housing projects or commercial development loans for office and retail developments.

Lenders evaluate your project’s feasibility, developer experience, and financial stability. Securing a property development loan Australia early ensures smooth cash flow and timely project delivery. FGS Finance plays a crucial role in this process, helping you prepare your application, improving the chances of approval, and providing competitive loan terms for your development projects.

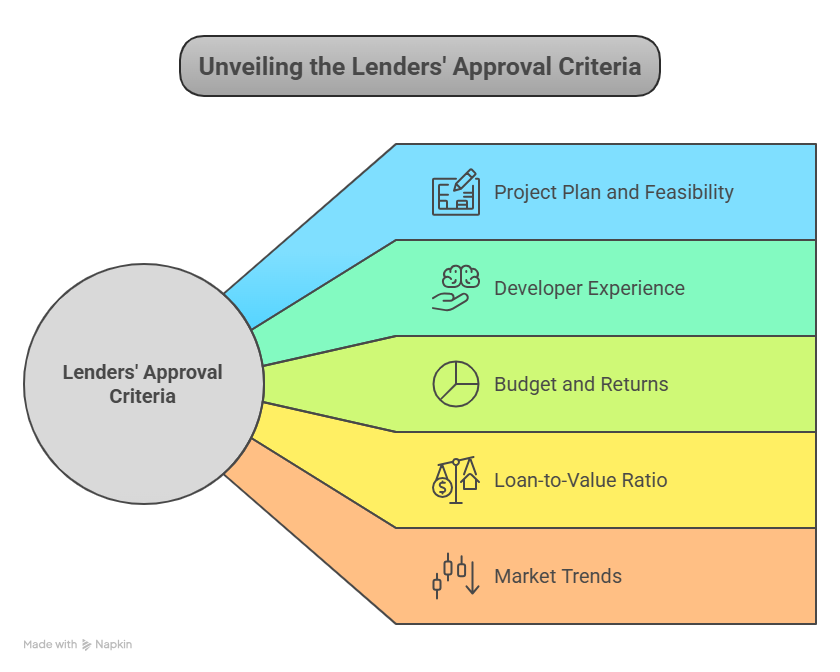

Key Factors Lenders Consider for Development Loan Approval

Lenders review several critical factors when approving construction development loans Australia. Proper preparation increases your approval chances.

- Detailed project plan and feasibility report

- Developer experience and past project success

- Accurate budget and projected returns

- Loan-to-value ratio and deposit contribution

- Market trends and demand for the development type

Addressing these factors thoroughly demonstrates reliability to lenders. FGS Finance guides you in organizing documentation, presenting transparent financials, and improving the likelihood of fast approval for your development loan.

Real-Life Success Stories of Development Loans

One residential developer secured a residential development loan Australia to build a townhouse complex. Proper planning, accurate cash flow projections, and guidance from FGS Finance helped complete the project on time and within budget.

A commercial developer used a commercial development loan Australia to construct a retail space. Challenges arose during construction, but careful monitoring and lender communication ensured the project remained on schedule.

Both cases demonstrate that precise planning, professional support, and a thorough understanding of lender requirements can transform development ideas into successfully completed projects. FGS Finance assists you every step of the way to make your property project a reality.

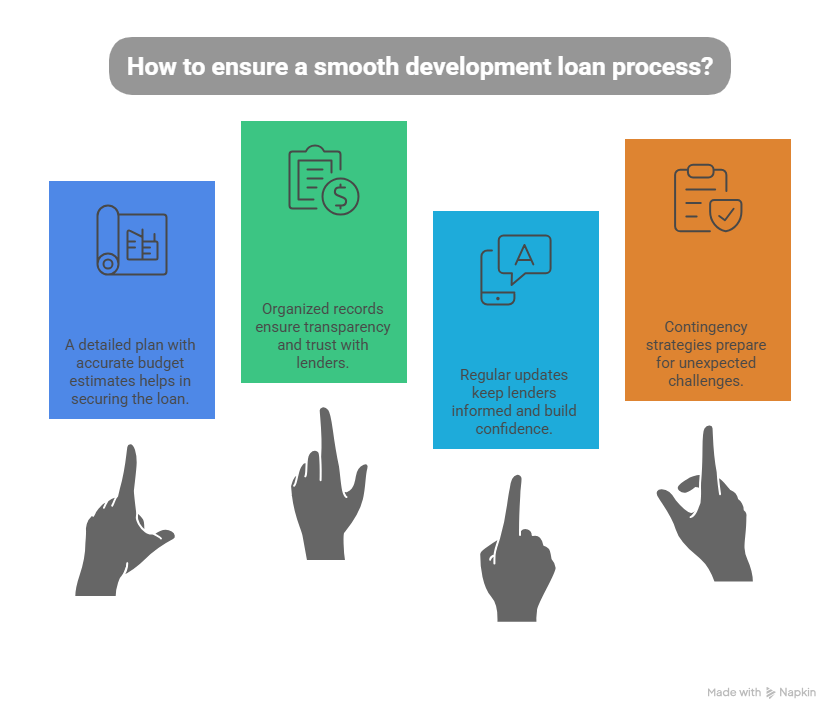

Tips for a Smooth Development Loan Process

Securing a property development loan Australia can be easier with the right approach. Follow these steps to avoid delays:

- Prepare a detailed project plan with accurate budget estimates.

- Maintain organized and up-to-date financial records.

- Communicate regularly with lenders and provide updates.

- Plan for potential risks and have contingency strategies

Following these tips streamlines the approval process and increases confidence in handling your development loan. FGS Finance ensures your application meets lender expectations and facilitates a smoother funding journey.

Common Mistakes to Avoid

Incomplete documentation or unclear financial plans can delay your development loan in Australia approval. Underestimating construction costs or ignoring market trends also reduces the chances of success.

FGS Finance helps you prepare accurate documents, highlight project feasibility, and avoid common mistakes. Working with professionals ensures faster approval, proper disbursement, and successful completion of your development projects.

Top 5 FAQs About Development Loans in Australia

- What is a development loan in Australia?

A loan that funds property development projects, including residential and commercial constructions.

- Who can apply for a property development loan?

Experienced developers or individuals with a clear project plan and financial capacity.

- How long does approval take?

Approval typically takes 2–6 weeks, depending on documentation and project size.

- Do I need collateral for a development loan?

Most lenders require security against the property or project assets.

- Can small developers access development loans?

- Yes, many lenders provide options for small-scale projects with proper planning and feasibility.

Conclusion

As we conclude, it’s important to remember that a development loan in Australia provides essential funding to complete property projects efficiently. With proper planning, accurate documentation, and professional support, you can increase approval chances and reduce delays, leaving you feeling optimistic and motivated about your property project.

FGS Finance plays a crucial role in this process, helping you prepare applications, manage cash flow, and secure funding for both residential and commercial developments. Their expert guidance and support are designed to reassure and support you throughout your property