Expanding your business often requires the right equipment. Truck & machinery loans provide fast access to capital for vehicles and machinery essential to operations. These loans help companies to grow, increase productivity, and manage cash flow efficiently. Understanding how to qualify, compare options, and secure quick approval is key. This guide provides real-world examples, practical tips, and strategies to help you secure the best loan terms in Australia.

Understanding Truck & Machinery Loans in Australia

A truck & machinery loan is designed to help businesses acquire trucks, machinery, or equipment without straining cash flow. You can use these loans for new or used assets. Options include low-interest loans and tailored plans for small businesses.

Lenders assess your financial records, business performance, and asset value. Tools like a truck and machinery loan calculator Australia help you plan repayments and evaluate affordability. FGS Finance assists in preparing applications and finding the best loan options to support your business growth.

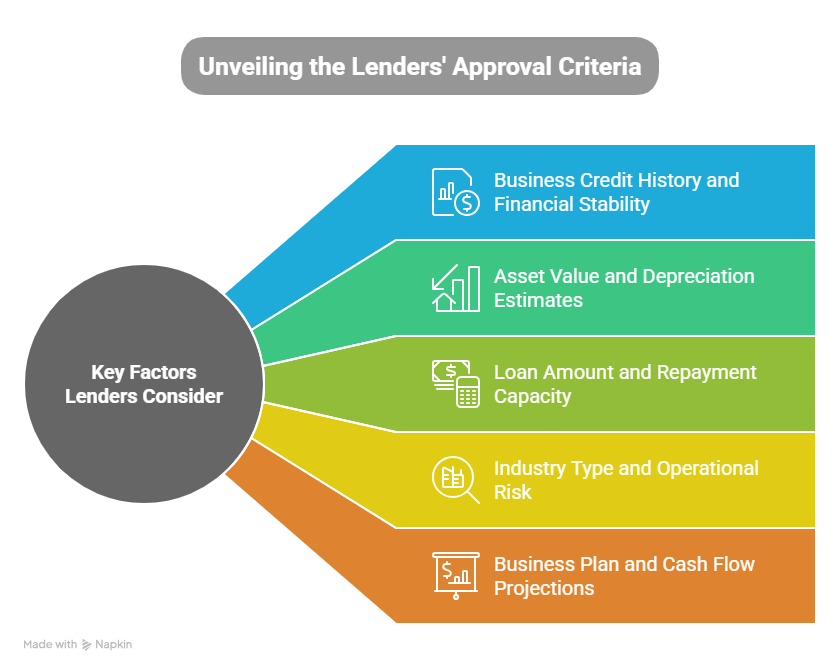

Key Factors Lenders Consider for Approval

Lenders review several aspects before approving a truck and machinery loan for small businesses Australia. Preparing these factors properly increases approval speed and improves terms.

- Business credit history and financial stability

- Asset value and depreciation estimates

- Loan amount and repayment capacity

- Industry type and operational risk

- Business plan and cash flow projections

FGS Finance guides you to organise documents, highlight strengths, and meet lender requirements. Proper preparation ensures faster approval and access to quick approval truck and machinery loans Australia.

Real-Life Examples of Australian Businesses Using Truck & Machinery Loans

A small logistics company expanded its fleet using a truck & machinery loan. With more trucks, delivery capacity improved, revenue increased, and operational efficiency rose. FGS Finance provided guidance to secure low-interest financing quickly.

A construction company acquired machinery through a low interest truck and machinery loan Australia. This investment reduced project delays and improved productivity on-site. The company compared lenders using a truck and machinery loan comparison Australia 2025 to select the best terms.

These examples show that proper planning, professional support, and lender guidance can make truck & machinery loans a powerful tool for business growth in Australia.

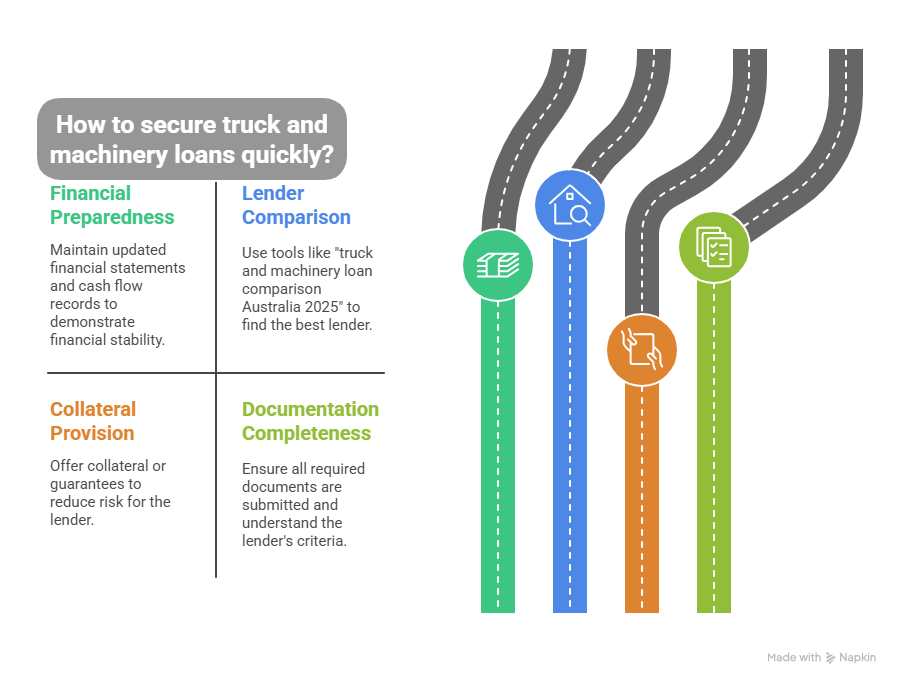

Tips for Securing Truck & Machinery Loans Quickly

Fast approval and smooth processing are possible with careful preparation. Consider these strategies for truck & machinery loans in Australia:

- Keep updated financial statements and cash flow records.

- Compare lenders using truck and machinery loan comparison Australia 2025

- Provide collateral or guarantees if required.

- Submit complete documentation and understand the lender’s criteria.

FGS Finance ensures your application meets all requirements. Following these tips helps businesses access funds faster and manage operations efficiently.

Common Mistakes to Avoid

Incomplete documentation, overestimating repayment capacity, and ignoring loan comparisons can slow approval for a truck & machinery loan.

FGS Finance helps businesses avoid these pitfalls by preparing accurate records, selecting the best truck and machinery loan options in Australia, and managing repayments. Expert guidance streamlines the process and secures financing for growth.

Top 5 FAQs About Truck & Machinery Loans in Australia

- What is a truck & machinery loan?

A loan that helps businesses purchase trucks, machinery, or essential equipment.

- Who can apply for these loans?

Small and medium businesses with financial records and operational plans can apply.

- How quickly can loans be approved?

Approval typically takes a few days to weeks if the documentation is complete.

- Do I need collateral?

Most lenders require collateral, but some offer unsecured options.

- Can self-employed businesses apply?

Yes, many lenders provide options for self-employed or small business owners.

Conclusion

Truck & machinery loans are a vital tool for Australian businesses looking to expand, increase efficiency, and grow revenue. Proper preparation, lender comparisons, and expert guidance are key to quick approval.

FGS Finance assists businesses in selecting the right loan, preparing documentation, and securing funding quickly. Contact FGS Finance today to expand your operations. Call 0431 170 021 or email info@fgsfinance.com.au for professional assistance and guidance