Looking for a smart way to fund your equipment or vehicles? With Asset Finance in Australia, you can secure the tools your business needs without draining cash flow. This guide walks you through the process step by step. From choosing the right asset loan to working with an asset finance broker, you’ll learn how to make financing simple. Whether you need trucks, machinery, or office equipment, discover how business asset finance can help your growth today.

What is Asset Finance and Why It Matters

If you run a business, you know that having the right assets can make or break success. Instead of paying up front for expensive machinery, trucks, or technology, you can use asset financing. It lets you spread the cost over time, keeping your cash flow steady while still getting what you need.

In Australia, an increasing number of businesses are choosing this option. Why? Because it gives you flexibility, control, and room to grow without unnecessary stress. With an asset loan, you invest in growth while protecting your working capital, providing a sense of financial security and peace of mind.

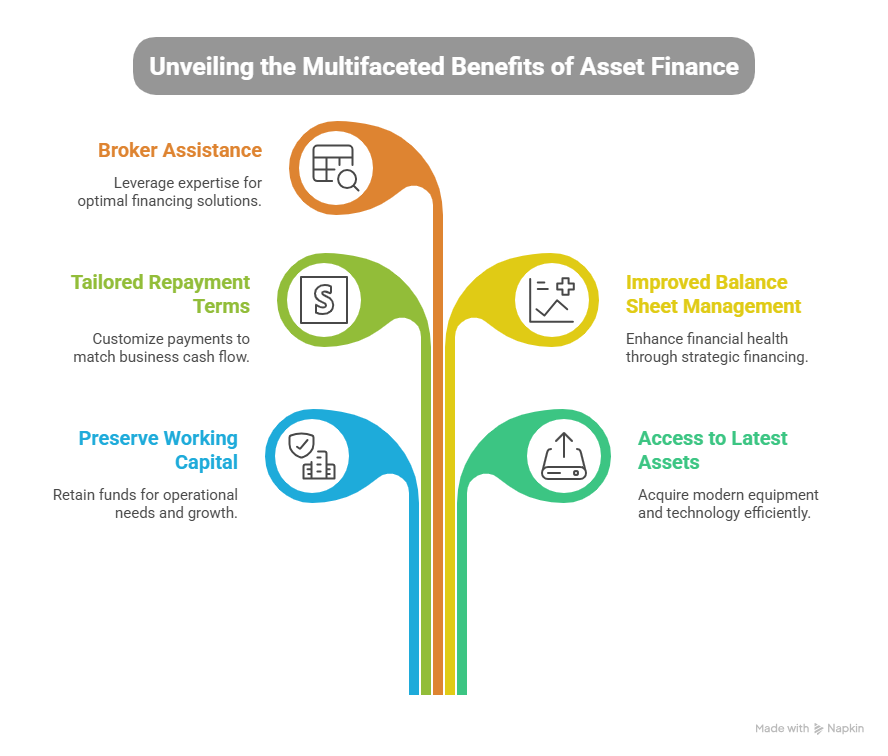

Benefits of Asset Finance in Australia

When you choose asset finance, you enjoy more than just funding. It gives you the freedom to grow your business faster. Here’s how it helps:

- Preserve your working capital and avoid large upfront payments.

- Access the latest machinery, vehicles, or tools with ease.

- Tailor repayment terms to suit your business cash flow.

- Improve balance sheet management with innovative financing.

- Utilise an asset finance broker to secure better deals.

By choosing business asset finance, you create a practical path to expand without risk. It helps you build stability while staying competitive in your industry.

Step-by-Step Guide to Applying for Asset Finance

Applying for asset finance in Australia is not complicated, but it works best when you know the process. Start by identifying what asset your business really needs. Once you know, research different loan types available, such as hire purchase, leasing, or chattel mortgage.

The next step is to compare lenders. An asset finance broker can be invaluable here. At FGS Finance, we guide you through available options and find the most cost-effective deal.

After that, prepare your paperwork. Lenders usually need details of your income, expenses, and financial history. Submitting complete information makes the process smoother.

Once approved, you can purchase the asset, and repayments will begin based on the agreement. By following these steps, you secure what your business needs with minimal stress and more control.

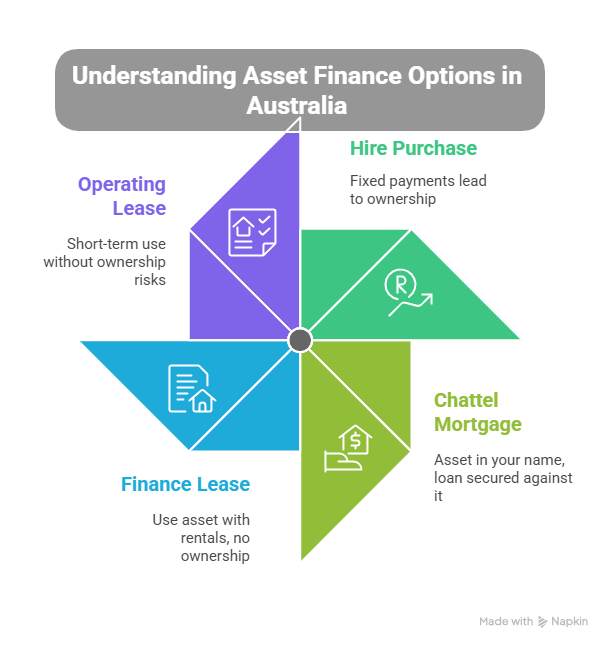

Common Types of Asset Finance in Australia

Not every asset loan is the same. Each type comes with its own benefits. Understanding them empowers you to choose the best option for your business, giving you a sense of control and confidence in your financial decisions:

- Hire Purchase – You make fixed payments until you fully own the asset.

- Chattel Mortgage – The asset is in your name, but the loan is secured against it.

- Finance Lease – You use the asset while paying rentals, but don’t own it.

- Operating Lease – Best for short-term use without ownership risks.

By understanding these types of business asset finance, you can choose one that best suits your needs. FGS Finance ensures you pick the option that supports both short and long-term growth.

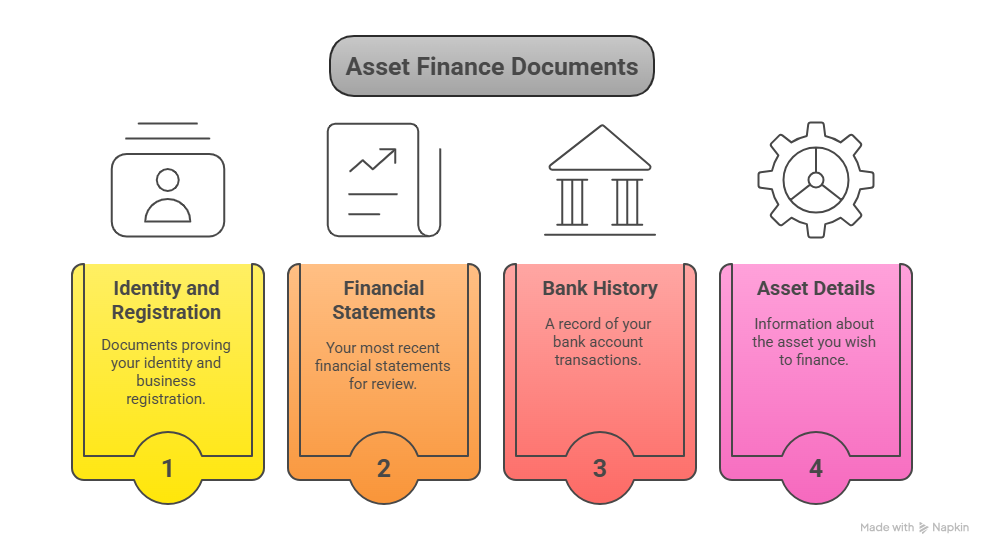

Documents You Need for Asset Finance

To apply smoothly for asset financing, prepare these documents in advance:

- Proof of identity and business registration

- Latest financial statements

- Bank account history

- Details of the asset you want to finance

Having these ready makes the process faster and increases approval chances. FGS Finance helps you organise everything to make applications stress-free.

FAQs About Asset Finance in Australia

1. What is asset finance in simple terms?

It is a loan that helps you buy business assets without paying the full cost up front.

2. Can asset finance help small businesses?

Yes, it is ideal for small and medium businesses looking to manage cash flow.

3. Do I need a broker for asset finance?

Although not required, an asset finance broker often finds better deals.

4. How long does approval take?

If documents are ready, approvals can happen in just a few days.

5. Is asset finance only for vehicles?

No, it covers a wide range of assets including trucks, machinery, equipment, and even office tools. If it’s essential for your business, chances are you can finance it.

Why Choose FGS Finance for Asset Loans

When you look for asset finance in Australia, you need a trusted partner. FGS Finance understands your business challenges and offers solutions that suit your needs. With our expertise, you save time, reduce costs, and get the right loan quickly, providing a sense of relief and convenience.

Ready to take the next step? Contact FGS Finance today at 0431 170 021 or email us at info@fgsfinance.com.au for tailored advice and support. We’re here to help you navigate the world of asset finance and find the best solution for your business.