Securing an investment loan in Australia can unlock opportunities for property wealth in 2025. With the right loan, you can grow your portfolio and increase returns. This guide explains types of loans, eligibility, and strategies to secure approval. Learn how investment loan brokers help you find the best investment loan options. Make informed choices and achieve success in property investing.

Understanding Investment Loans in Australia

An investment loan in Australia is designed for people who want to buy property to rent out or hold for capital growth. Unlike a standard home loan, this loan focuses on your ability to generate income and manage repayments from your investment.

Choosing the right option matters because property investing requires planning. Many investors use investment property loans to build wealth and secure financial stability for the future. With clever use, this loan can help you grow assets while keeping repayments manageable, providing a sense of security in your investment journey.

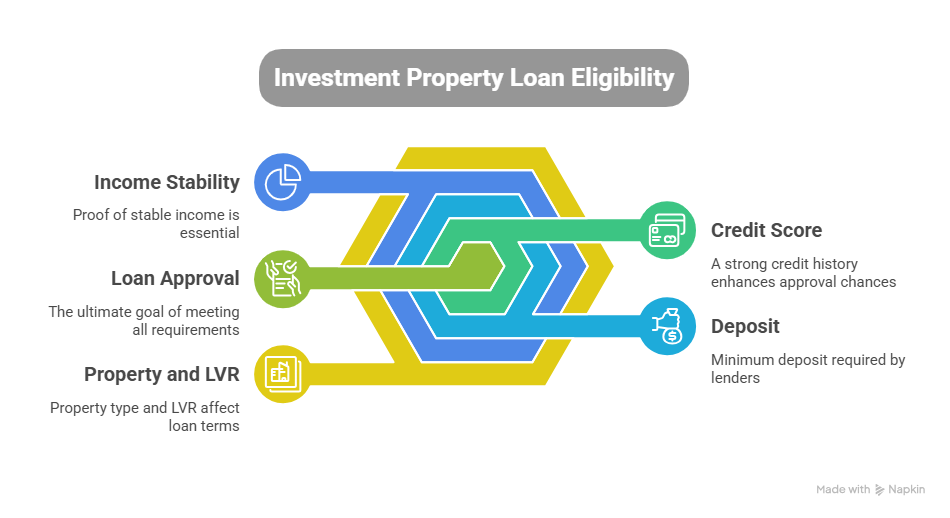

Key Eligibility Requirements for Investment Property Loans

To qualify for an investment loan in Australia, you must meet specific criteria. Lenders check your financial position, income sources, and the type of property you want to invest in.

Here are the key requirements you need to know:

- A strong credit score improves your chance of approval.

- Most lenders ask for a deposit of at least 10% to 20%.

- You need stable proof of income from employment or rent.

- Property type and location affect loan approval.

- LVR (loan-to-value ratio) usually sits around 80%, sometimes higher with extra conditions.

Meeting these standards makes the process smoother. Working with investment loan brokers can save you time and connect you with the right lenders who match your goals.

Types of Investment Loans Available in Australia

When you explore investment loans in Australia, you’ll see different options. Some suit short-term goals, while others focus on long-term growth.

Fixed-rate loans give you repayment stability for a set time. Variable-rate loans, on the other hand, move with market interest rates, which can lower or increase repayments.

You can also choose between interest-only loans or principal and interest repayments. Interest-only loans keep your costs lower at the start, while principal and interest reduce your debt over time.

The best property investment loans in Australia depend on your income, strategy, and the kind of property you buy. By matching the right loan with your plan, you can maximise returns while keeping risks under control.

How to Secure the Best Investment Loan in Australia

Getting the best investment loan requires planning and preparation. If you want to make the process easier, follow these steps:

- Compare lenders and their offers before making a choice.

- Use investment loan brokers to access a broader range of loans.

- Prepare documents like tax returns, payslips, and rental statements.

- Improve your credit score to qualify for lower interest rates.

When you prepare ahead, you show lenders that you’re serious about managing your investment. With the right strategy, you can secure an investment property loan that matches your financial goals.

Benefits of Using Investment Loan Brokers

Working with investment loan brokers gives you more than convenience. A broker understands the lending market and can match you with lenders who suit your financial profile.

Brokers also save you hours of research by comparing loan features, interest rates, and hidden fees. With expert support, you can access the best investment loan options without confusion.

Top 5 FAQs about Investment Loans in Australia

1. What is an investment loan in Australia?

It is a loan used to buy property for investment purposes, not for living in.

2. How much deposit do I need for an investment property loan?

Most lenders ask for 10% to 20%, though some options require more.

3. Are investment loan interest rates higher than home loans?

Yes, interest rates are often slightly higher compared to owner-occupied loans.

4. Can first-time buyers apply for investment property loans?

Yes, but lenders check your income and ability to repay before approval.

5. What’s the role of an investment loan broker?

A broker helps you find, compare, and secure the right loan from different lenders.

Final Thoughts on Investment Loans

An investment loan in Australia can give you the chance to grow wealth and secure your future. By choosing wisely, you can invest in property with confidence.

FGS Finance works as your trusted partner to simplify the process and guide you toward success. Reach out today to start your investment journey with expert support.

📞 Phone: 0431 170 021

📧 Email: info@fgsfinance.com.au