Getting approved for a Personal Loan in Australia requires preparation and understanding of lender requirements. This guide explains the steps to improve your approval chances. Learn how personal loan brokers can assist in finding the best options. Explore strategies to access low interest personal loans. FGS Finance helps you navigate the application process smoothly and secure the right loan for your needs.

Understanding Personal Loans in Australia

A Personal Loan in Australia provides funds for a variety of needs, including debt consolidation, emergencies, or major purchases. Lenders assess your income, credit history, and financial stability before approval. Understanding this process can bring a sense of relief, helping you apply with confidence and increasing your chances of success.

Australia personal loans come in secured or unsecured options. A secured loan is backed by collateral, such as a car or property, which can lower the interest rate but also puts your asset at risk if you default. An unsecured loan, on the other hand, doesn’t require collateral but usually comes with a higher interest rate. Working with personal loan brokers simplifies comparisons and helps identify low interest personal loans that suit your financial goals. FGS Finance assists clients by reviewing eligibility, explaining loan terms, and guiding them toward the most suitable personal loan.

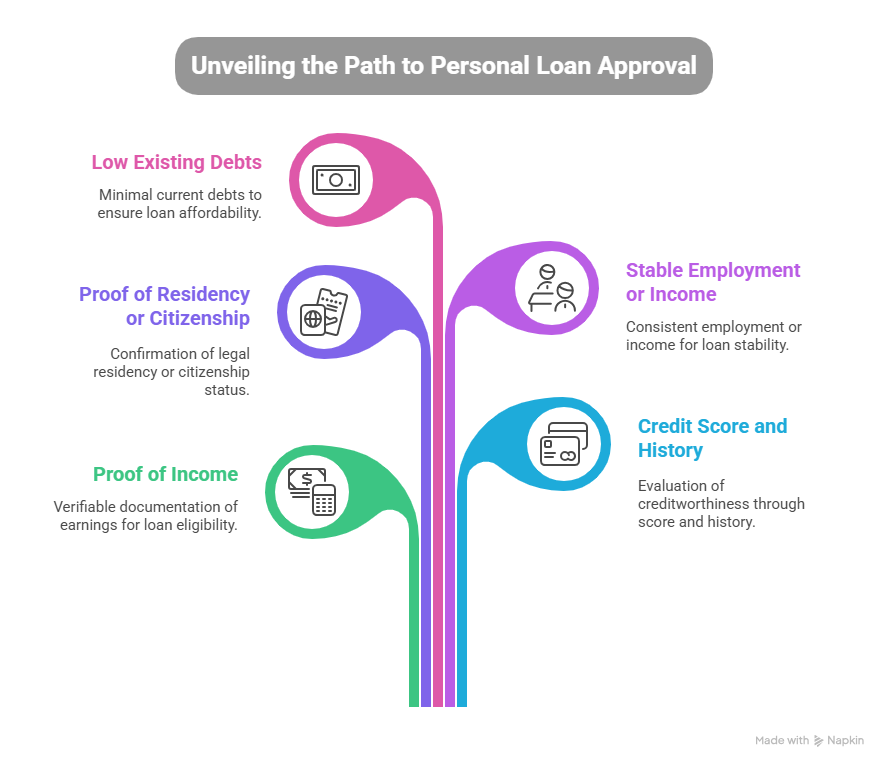

Key Requirements for Personal Loan Approval

Knowing lender requirements improves your approval chances and prevents delays.

- Proof of income, such as payslips or tax returns.

- Satisfactory credit score and credit history.

- Proof of residency or Australian citizenship.

- Stable employment or regular income.

- Low existing debts and manageable repayments.

Meeting these requirements makes approval easier. FGS Finance helps clients prepare documentation, assess credit, and match with the right personal loans Australia to meet their needs.

Tips to Improve Your Loan Approval Chances

Maintain a strong credit score. Pay off overdue bills, reduce credit card balances, and avoid multiple applications at once. Lenders carefully review your credit when approving a Personal Loan in Australia.

Ensure stable income and employment history. Lenders favour consistent earnings. Providing detailed financial records supports your application.

Use a personal loan broker to access multiple lenders and compare options. Brokers help find low interest personal loans and guide you through the application. FGS Finance evaluates your financial profile, suggests suitable loans, and simplifies the process to save time and increase approval chances.

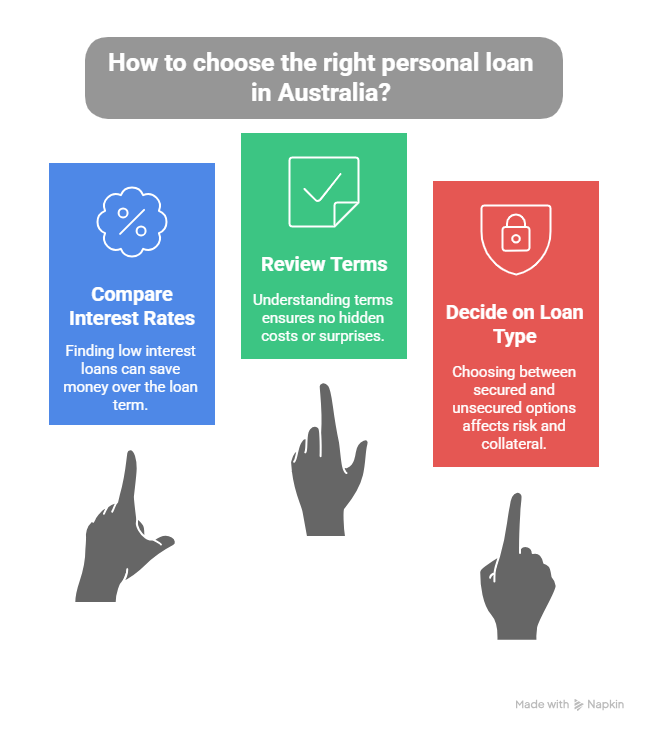

Choosing the Right Personal Loan in Australia

Selecting the right loan ensures affordability and repayment flexibility.

- Compare interest rates to find low interest personal loans.

- Review terms, including repayment period, fees, and charges.

- Decide between secured and unsecured options.

- Use personal loan brokers to explore multiple lenders efficiently.

FGS Finance helps clients assess loan products, compare rates, and select the right personal loan based on income, repayment capacity, and financial goals. Expert advice ensures smoother approval and better loan outcomes.

Common Mistakes to Avoid When Applying

Avoid applying without checking your credit score. Inaccurate or outdated reports can delay approval. Always verify your financial status before submission.

Do not ignore fees or hidden charges. FGS Finance helps clients understand total costs and avoid high-interest traps. By avoiding these common mistakes, you can feel more secure in your financial decisions, improving your approval chances and securing affordable Australia personal loans.

Top 5 FAQs

What is a personal loan in Australia?

A loan that provides funds for debt consolidation, emergencies, or large purchases.

Can I get a low interest personal loan?

Yes, comparing lenders or using a personal loan broker helps secure lower rates.

Do I need a good credit score for approval?

Yes, lenders check your credit history to evaluate your reliability.

Can I apply for personal loans online?

Many lenders provide online applications for convenience and speed.

How can a personal loan broker help?

Brokers compare multiple lenders, recommend suitable options, and simplify approval.

Final Thoughts on Personal Loan Approval

Approval for a Personal Loan in Australia depends on several factors, including preparation, credit standing, and the selection of the right loan. Understanding requirements ensures better success and fewer delays.

FGS Finance guides clients through eligibility checks, loan comparisons, and the application process. Start your journey with expert advice today. Contact FGS Finance at 0431 170 021 or email info@fgsfinance.com.au for personalised support and the best loan options.