Buying your first home can feel overwhelming, but careful planning makes it easier. This guide covers everything a First Home Buyer in Australia needs to know. Learn how to prepare financially, explore home buyer finance in Australia, and understand government schemes like the First Home Guarantee. FGS Finance, a trusted partner in the home-buying process, helps you navigate the process confidently. Use this checklist to make your first home purchase simple and stress-free.

Understanding the First Home Buyer Landscape in Australia

The Australian property market has seen rising demand from first home buyers Australia, making preparation essential. Understanding market trends, interest rates, and deposit requirements can save you time and money. This knowledge provides a sense of relief and confidence, helping you make smarter decisions and avoid common pitfalls.

Financial readiness is key for first home buyers in Australia. Knowing your borrowing capacity, exploring home buyer finance in Australia, and understanding government programs like the First Home Guarantee give you an advantage. This knowledge empowers you, and FGS Finance can guide you through the steps, ensuring your first home purchase is smooth and manageable.

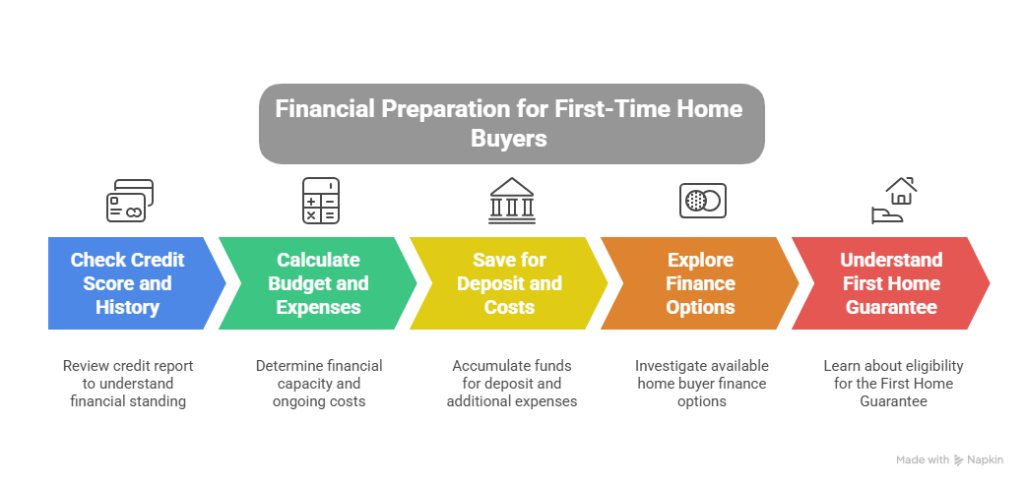

Financial Preparation Checklist for First-Time Buyers

Financial preparation is the foundation of a successful home purchase. Start by assessing your income, expenses, and available savings. This checklist ensures you are ready to apply for a loan and reduces surprises during the buying process.

- Check your credit score and history.

- Calculate your budget and ongoing expenses.

- Save for a deposit and additional costs, such as stamp duty and insurance.

- Explore home buyer finance in Australia options.

- Understand eligibility for the First Home Guarantee.

Taking these steps improves your loan approval chances and gives you confidence. FGS Finance works closely with first-time buyers to tailor solutions that match their financial situation.

Government Schemes and Assistance Programs

Australia offers programs to support first home buyers Australia. The First Home Guarantee helps reduce deposit requirements, making it easier to enter the property market. First Home Owner Grants provide extra financial support for eligible buyers.

Eligibility depends on factors such as income, property price, and prior ownership. Using these schemes wisely can significantly lower upfront costs. FGS Finance can assess your eligibility and guide you through applications to maximise benefits.

State-based incentives also exist. Combining federal and regional programs can make homeownership more achievable. FGS Finance ensures you leverage all available assistance to secure your first home efficiently.

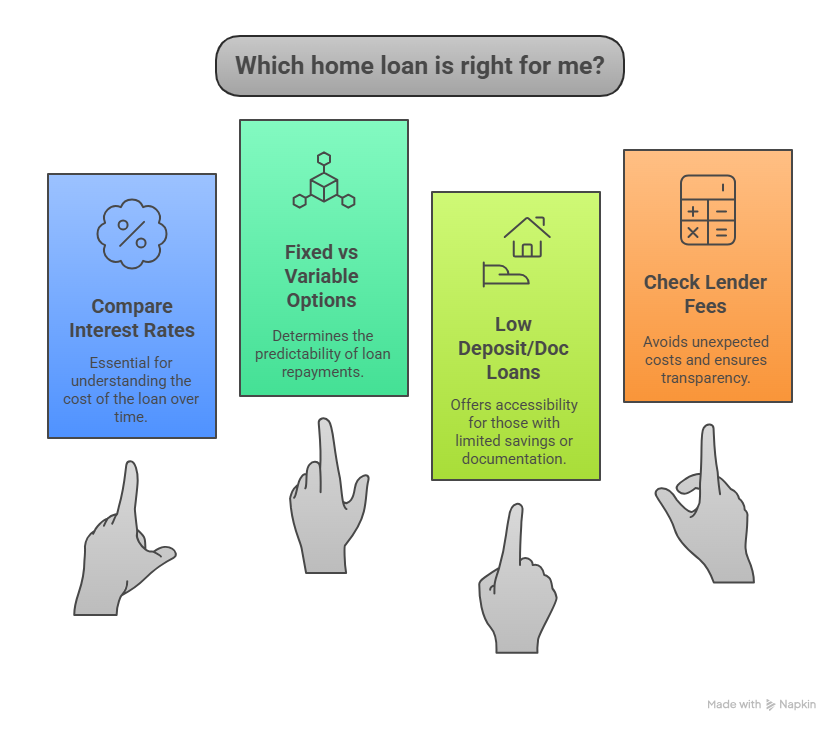

Choosing the Right Home Loan for First-Time Buyers

Selecting the right home loan affects your long-term financial health. Consider interest rates, flexibility, and repayment options carefully. The right loan keeps your budget manageable and avoids future stress.

- Compare interest rates and loan features.

- Decide between fixed and variable options.

- Explore low deposit and low doc loans.

- Check lender fees, hidden costs, and flexibility.

Careful loan evaluation ensures affordability and peace of mind. FGS Finance helps you identify the best First Home Buyer in Australia loan options that fit your needs and goals, providing a sense of security in your decision.

Additional Tips for First-Time Home Buyers

Attend open homes and inspections to understand property values. Working with a mortgage broker simplifies paperwork and ensures you get the proper guidance.

Plan for long-term financial stability. Build an emergency fund, consider future property growth, and know the responsibilities of homeownership. FGS Finance supports first-time buyers in making informed decisions for a secure future.

Top 5 FAQs

What is the First Home Guarantee?

It helps first-time buyers purchase a home with a smaller deposit.

How much deposit do first home buyers need in Australia?

Usually 5–20% of the property value, depending on the loan and schemes.

Can self-employed people apply for first home loans?

Yes, self-employed individuals can apply for first home loans. In fact, there are specific loan options, known as ‘low doc loans’, designed for self-employed buyers. These loans require less documentation than traditional loans, making it easier for self-employed individuals to qualify for a mortgage.

Are there grants for first home buyers?

Yes, including the First Home Owner Grant and state-specific programs.

How long does it take to get approved for a first home loan?

Approval usually takes 2–6 weeks based on documentation and lender requirements.

Final Thoughts for First-Time Home Buyers

Preparation, financial planning, and understanding government schemes make homeownership achievable. FGS Finance guides first-time buyers through every step, ensuring a smoother process and fewer surprises.

Use this checklist as your roadmap to purchase your first home with confidence. Contact FGS Finance today at 0431 170 021 or email info@fgsfinance.com.au to start your journey with expert guidance.